We are already used to paying at supermarkets via a smartphone and receiving banking services from “robots”. Over the last few years, everything connected with the word “digital” has changed the world of finance. However, the real transformation has only just begun.

Hard to believe? Right now, only 30% of financial companies are implementing a digital transformation strategy. This means there is much work to do in the future for the majority of financial organizations both in terms of developing and implementing digitalization. This is what we do here at MindK – help financial institutions digitalize by developing custom solutions to support their digital transformation initiatives.

A digital transformation strategy is top priority for many companies, so it’s very important to understand what trends to include in your financial services digital strategy to keep up with or get ahead of competitors. That’s exactly what we’ll zero in on in this article.

But before we move to tech trends in the financial sector, let’s first clear up WHY there is a huge demand for financial services transformation. This information will help you better understand why this or that tech trend is disrupting financial services now and build a more solid digital transformation strategy for your company.

Key drivers of digital transformation trends in financial services

There is a generally held opinion that the COVID-19 pandemic catalyzed the digitalization process of the financial industry. However, this is only partially true. Digitalization of the financial sector began long before the pandemic.

It was driven mostly by emerging FinTech companies that approached financial services from a more technological viewpoint. They applied the latest FinTech trends which, as a result, provided people with an improved digital experience, accessibility, speed, and lower product and services cost.

Moreover, Big Techs including Google, Apple, Amazon, and Facebook have also expressed their intention to move into financial and banking services.

Everything taken together — the emerging high-technology FinTech companies and big tech players — challenged most financial institutions like traditional banks, investment firms, payment service providers, and so on, putting pressure on transforming not only their digital strategies, but also core business models to stay competitive.

The pandemic put digital transformation initiatives into the spotlight. Banks started reassessing the way they deliver services shifting focus to comprehensive digitalization, building online platforms and IT systems, and creating better customer experience.

But an even greater shift happened in the way financial institutions collaborated with each other. COVID-19 highlighted the opportunities for new forms of collaboration. This gave rise to a new trend in finances called FinTech ecosystems. This type of partnership can include startups, financial institutions, investors, and government initiatives. They aim to improve financial services with the use of technology, winning customer loyalty.

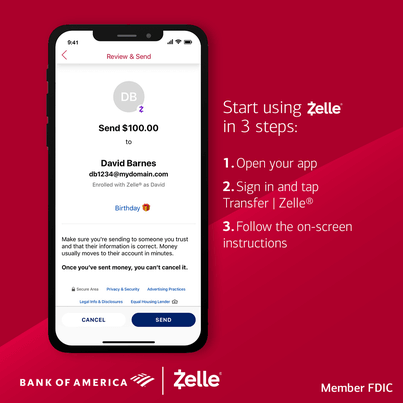

For example, a partnership of Bank of America and a money transfer app Zelle allowed bank customers to easily send and receive money from relatives, friends, and acquaintances.

Now that we understand the major drivers behind the digital transformation in financial services, it’s time to dive deeper into the trends that disrupted the industry.

Digital transformation trends that are changing financial services here and now

The financial sector is huge. It comprises a wide range of services, from wealth management and investment to banking and insurance. To be more specific about the trends changing financial services, we divided the financial services into four big groups: banking, investment, insurance, and tax and accounting. Let’s see what is disrupting each of these domains, starting from digital banking trends.

Banking

Banking becomes more digital

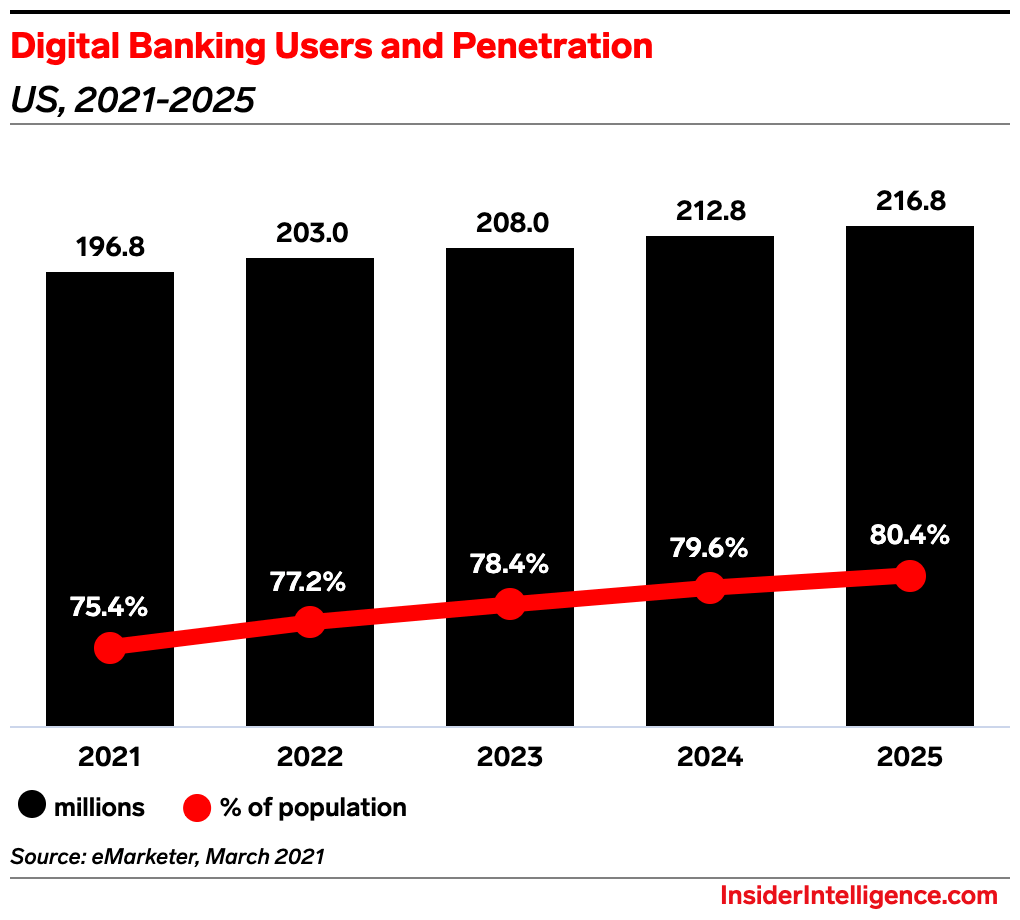

As we’ve mentioned above, with an increased number of FinTech companies offering better digital financial services, the customer demand for digital banking services increased significantly. Clients are seeking more efficient ways to access banking services and complete financial transactions without being tied to local branches.

This has led to a number of technological improvements within financial institutions, with automation and artificial intelligence (AI) at the heart of this change. It’s how the term “digital banking” was coined.

Digital banking is not only about online or mobile banking services, it is about the digitization of all banking levels, from the front-end to the back-end. This means that digital banks are the banks that manage to automate administrative tasks and data processing, as well as provide clients with a better digital experience. For example, they allow making account deposits and transfers remotely, enable people to apply for loans and access personalized money management services online.

App-based banking and financial services (neobanks) take the stage

Where there’s demand, there’s supply. In the situation when people demanded a better and simpler digital banking experience with lower cost than traditional banks, the supply didn’t keep us waiting long. This is how digital-only banks (or neobanks) came into play.

The fundamental difference between neobanks and traditional banks is that neobanks are completely digital. Instead of having costly networks of physical branches, neobanks provide online banking services that can be accessed through a computer, tablet, or smartphone.

Neobanks fall into two large groups:

- full-stack neobanks that operate independently and have their own banking license; and

- front-end focused neobanks which don’t have banking license, thus have to work in collaboration with either a traditional or legacy bank to be able to provide services to consumers.

Initially, neobanks received little trust from clients, but now the trust is growing significantly. Today there are more than 170 neobanks in the world and the number of digital-only bank account holders continues to grow. It is predicted that by 2024 there will be 47.5 million digital-only bank account holders in the USA alone.

This is not surprising as neobanks, as a rule, provide a great range of services, which includes 100% bank-client interaction online, fast bank account opening and client onboarding, simple UX/UI mobile application, favorable terms of deposits and loans, and continuous customer support.

Innovations in payments are here

No other banking service has seen more innovations than payments. Today, payments are becoming faster, more secure, and more embedded. In our article about the current FinTech trends, we described what embedded finance and payments are and how they’ve invisibly entered our lives, so check it out.

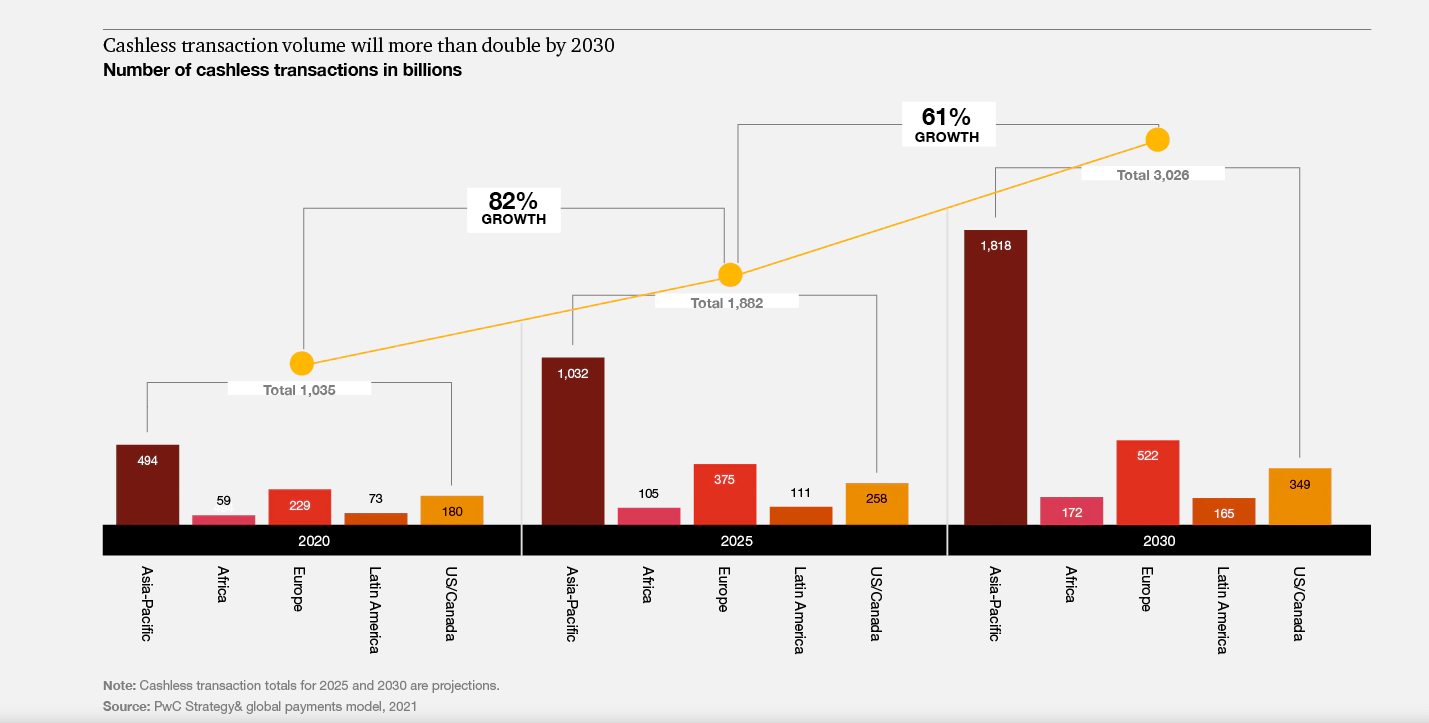

The Payments 2025 & beyond report by PwC, predicts that cashless payment volumes will almost triple by 2030.

Such a shift to cashless operations results in more significant and extensive transformations. It affects not only traditional methods of payment for services or goods, but also reshapes the entire payment infrastructure and develops new business models.

This shift basically has two major trends:

- evolution of front- and back-end parts of payment systems, which involves contactless payments, instant payments, digital wallets, P2P payments, and so on; and

- revolution of the payment ecosystem, which results in more serious structural changes, for example, “buy now, pay later” (BNPL) offerings, cryptocurrencies, digital currencies from the central banks, and similar.

A BNPL offering is worth special attention here, as it has changed the payment ecosystem almost overnight and forced traditional banks and payment providers to play catch-up.

BNPL is a type of short-term financing that enables clients to purchase goods or services and pay for them in the future, often interest-free. More than 39% of Americans admit that they’ve already tried BNPL at least once.

BNPL has greatly affected not only banks and debit issuers, but also credit card and personal loan providers. Amid the COVID-19 pandemic, such FinTech service providers like Klarna, Affirm, Afterpay, and others, succeeded with their BNPL services and expanded their client base which gave banks one more reason to be worried and to rethink their service set.

Cloud-native technology is at the heart of digital transformation in banking

One of the most compelling reasons for banks to adopt the cloud is the increased control it provides. Because of increased control and transparency, banks can easily audit processes and information. All data is available in real time and is easily accessed and backed up. Among other advantages the cloud provides are:

- Cost savings: moving business apps and data to the cloud frees the banks from storing them locally. This means no physical infrastructure is required and, at the same time, there are no costs related to maintaining, and housing hardware.

- Flexibility: cloud-based operating models are flexible enough to allow banks to experience shorter development cycles for new products. It also allows banks to respond to client needs faster and more efficiently.

- Improved security control: partnering with the right cloud provider provides increased security, which is a driving force in the financial industry. Cloud solutions propose data encryption, enhanced credentialing, SSL management, and much more to make your data as secure as possible.

Let’s take, for example, payment processing. When opposed to managing and maintaining expensive and rigid on-premise systems, using a cloud-based Payments-as-a-Service platform (PaaS) dramatically reduces capital expense. It also lowers operational risk by removing the limitations of outdated internal IT systems thanks to the agility provided by a cloud-based PaaS.

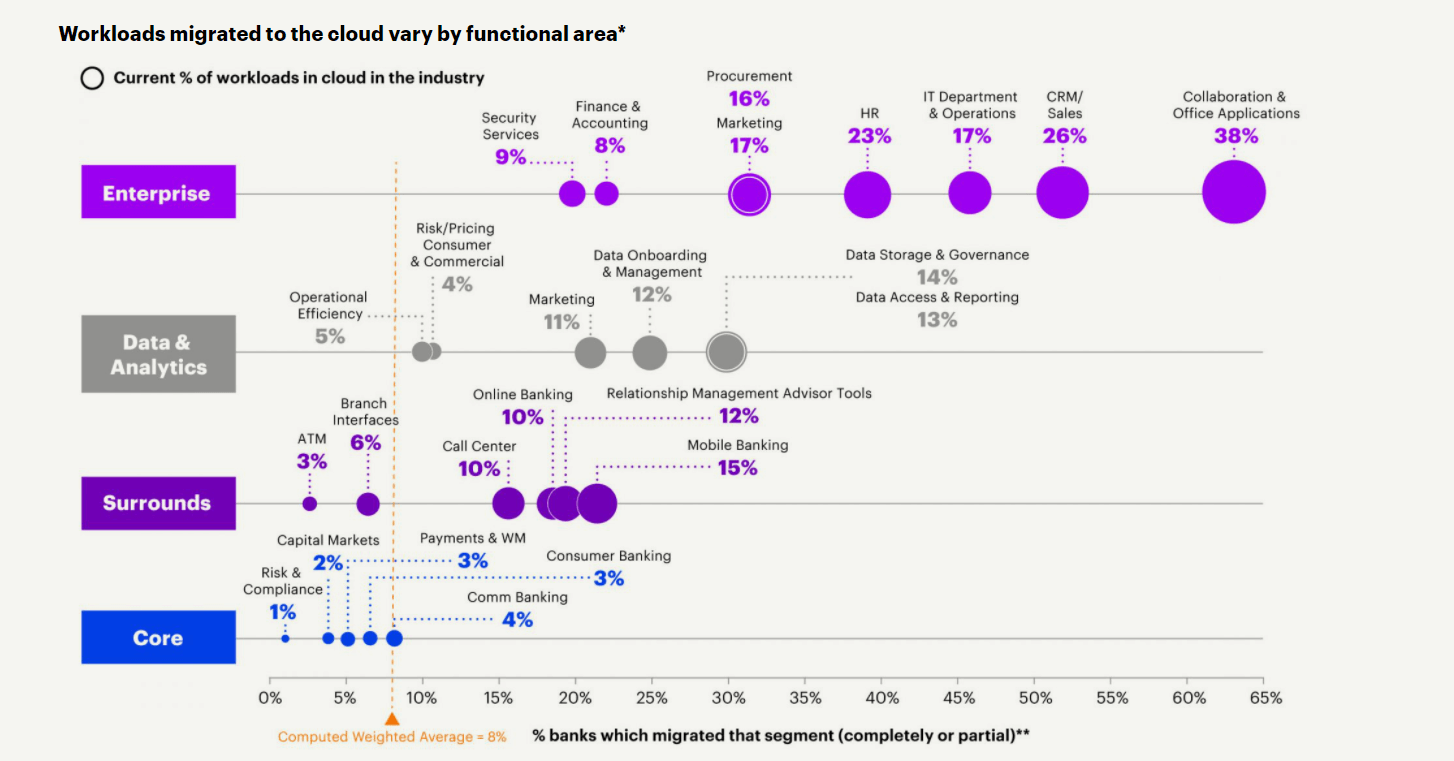

In spite of all the benefits of the cloud, for many banks, the journey to the cloud has just begun and is now moving into top gear. For instance, banks handle only 12% of their tasks on the cloud in North America and only 5% of workflows in Europe. However, it’s predicted that cloud adoption will double in the next two years.

Source: bankingblog.accenture.com

API-based banking is gathering speed

APIs (Application Programming Interfaces) are the unsung heroes of the digital age. They help developers integrate third-party features, exchange data between apps, and connect enterprise systems. In other words, an API is an interface that allows various pieces of software to communicate with each other.

In a banking context, APIs allow a third-party application to access a bank’s common tools, services, and valuable assets, like financial information, customer accounts, and similar. In this light, APIs make it faster, more convenient, and cost-effective for the bank and third-party companies to connect.

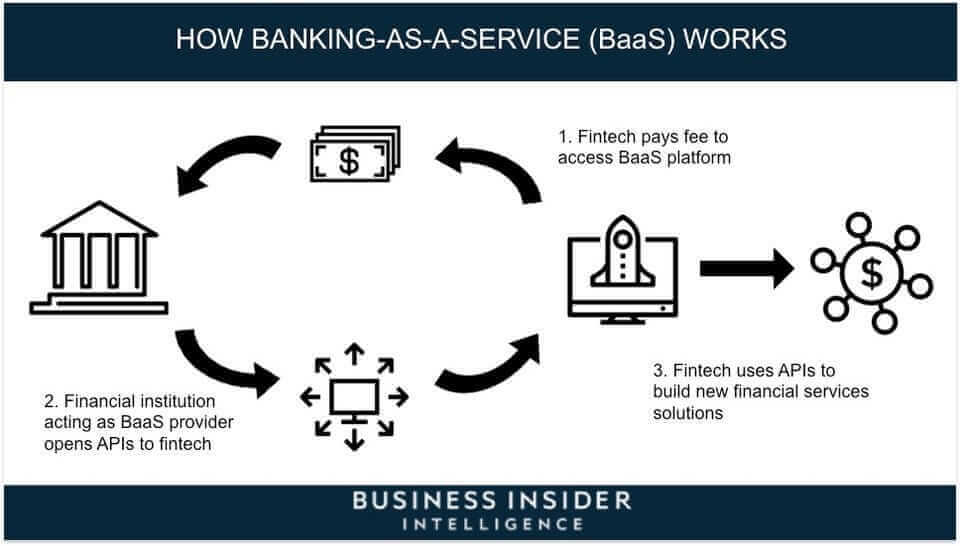

API underlies several fundamental trends in the banking industry. Among them are Open banking and Banking-as-a-Service (BAAS).

Open banking (also called open bank data), allows banks to give access and control over client banking transactions and financial data to other companies via APIs. Around 97% of companies that have already adopted open banking admit it has brought value to their business, namely improved customer service, client engagement, ability to deliver new services, and generation of new revenue streams.

Banking-as-a-service is a game-changing end-to-end model that enables providing banking infrastructure through APIs. The main goal of the BaaS service is to enable financial companies and FinTech startups to build banking offerings on top of the providers’ regulated infrastructure. It means running finance operations and building new financial solutions is possible now without organizing your own bank.

There are pure BaaS providers, FinTech companies that propose BaaS functionality, and traditional banks that open their banking infrastructure and licenses to other FinTech players by means of APIs. The Financial Services State report by Finastra states that Banking-as-a-service will have a major impact on 85% of global financial institutions.

Insurance

Digital transformation in insurance is slower than other industries because of the rigid and forever changing regulation policy that delays the deployment of new technologies. However, as far as the clients are moving online in almost all spheres of their lives, expectations of insurers are also changing. Insurance companies have to fall in line.

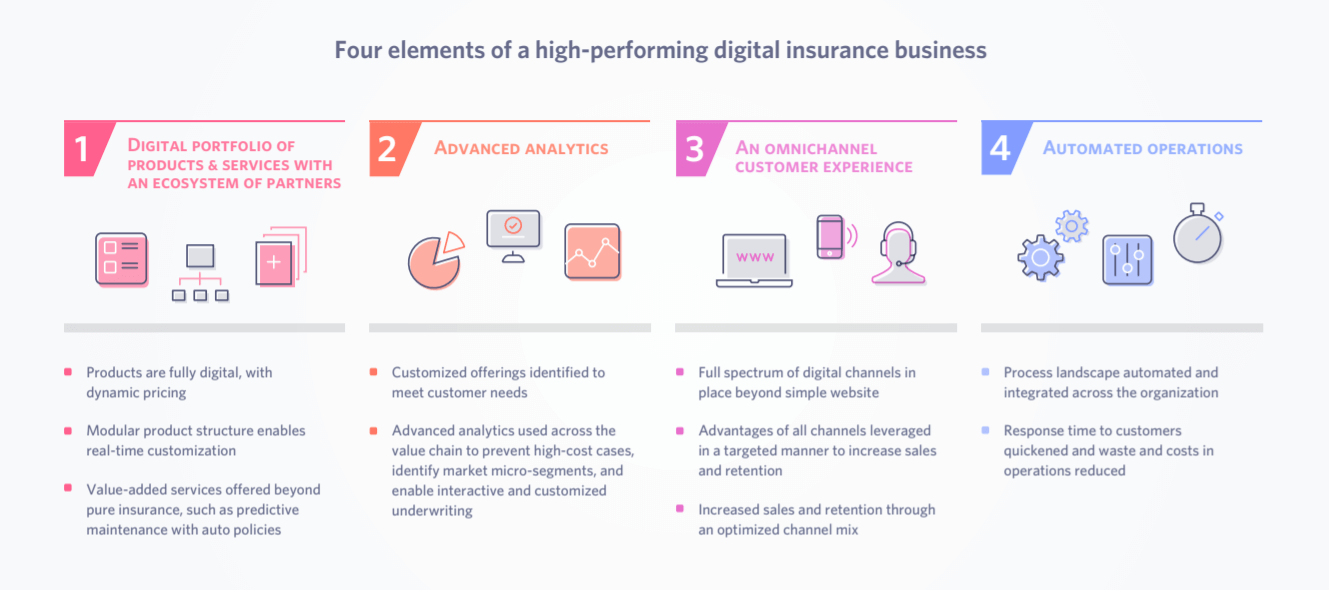

According to McKinsey, the high-performing digital insurance business is based on four fundamental elements:

- a digital portfolio of products and services within an ecosystem of partners;

- advanced analytics;

- an omnichannel customer experience; and

- automated operations.

Digital disruption in insurance: Cutting through the noise

Source: mckinsey.com

Digital portfolio of products and services within an ecosystem of partners

This element presupposes using a number of current technological trends like AI, dynamic pricing, IoT, and so on. The report highlights that a product portfolio should be digital and apply dynamic pricing. Dynamic pricing allows constant adjustment of the pricing in real-time based on predictive analytics that analyses a wide variety of potential factors to offer the best pricing.

It’s becoming increasingly difficult for insurers to rely only on their underwriting abilities. There is a need to establish an ecosystem around the data stream by partnering with companies from other industries and offering products and services, of which insurance is only one component.

Advanced analytics

Insurance companies are increasingly turning to advanced analytics. It can help the company mine through loads of data for relevant insights that can be used in a variety of business scenarios. It helps not only with decision-making and protecting the business from dangers, but also for identifying new growth opportunities based on client data.

Among the business use cases powered by advanced analytics are:

- Detection of fraudulent claims, a huge problem for insurance companies – the total cost of insurance fraud (non-health insurance) is more than $40 billion a year. Predictive analytics helps to detect fraudulent activities, suspicious claims, and behavioral patterns.

- Mitigating risk in real-time allows companies to be quick on their feet to violate these risks.

- Building personalized marketing strategies, plans, prices, recommendations contributes greatly to customer acquisition success and, as a result, increases company image.

- Predicting lifetime value allows predicting customer buying intentions and developing individual retention plans.

Advanced analytics is considered a future competency at the heart of how the business will be done across the value chain, taking the levels of automation even further.

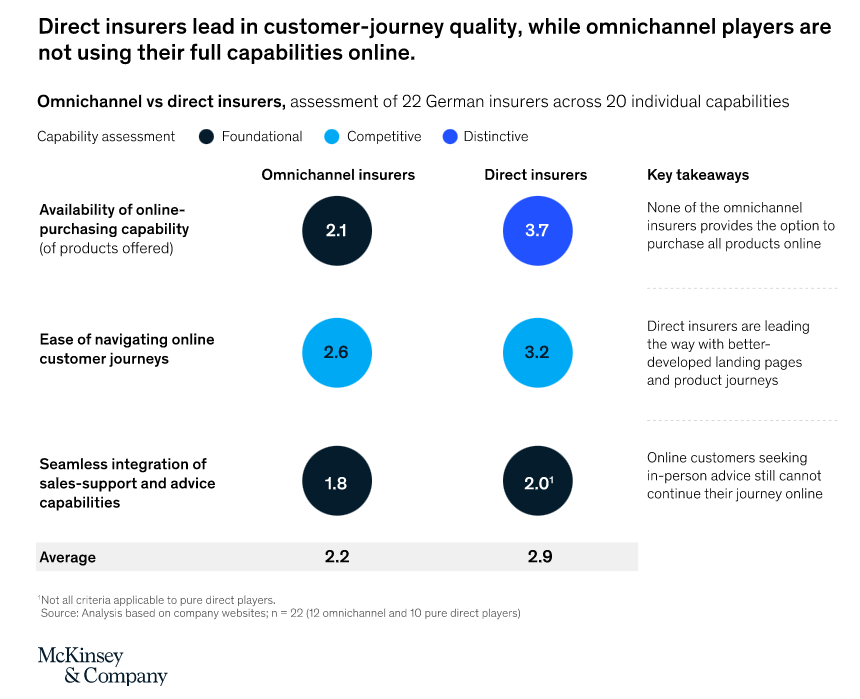

Omnichannel customer experience

It goes without saying that clients now want access to insurance services through a number of channels with the same level of user experience. So more and more insurers are transitioning to a user-first, omnichannel strategy to stay competitive.

The most successful will focus on these elements: providing online purchasing capabilities, smooth navigation, and online customer journeys, as well as integration of sales support and advice capabilities.

Automated operations

The main benefit of the process automation adopted today across insurers, is the boost to customer satisfaction while lowering operating costs. However, besides traditional process automation that automates all the processes on every step of the value chain, insurers start adopting robotic process automation (RPA) with advanced AI to streamline the whole process.

According to McKinsey & Company, the insurance sector will potentially automate 25% of its processes by 2025, with RPA technology at the heart of the change. Although, it’s important to note that as far as every layer is affected, achieving a high level of automation requires fundamental changes of the IT architecture.

A great example of digitalization in insurance is our client Innmeldt, a consulting agency that advises top Norwegian companies and employees on pensions and insurance. Previously, all the consulting process was done manually which was time-consuming. Moreover, Norway has a complicated pension system, so to understand pension payments, people must register in several systems and make calculations based on an advanced formula.

We helped the client to digitalize the whole process by developing a SaaS solution that involves customized web portals and a powerful management system working together. This way, the information portals help customers see transparent data on insurance and pension, while a management system allows Innmeldt to make the consulting process fully digital, driving more revenue.

Investment services

Investment services including asset and wealth management are in the midst of significant change. Around 77% of US- and Canada-based financial advisors admitted that they have lost business as they didn’t have the necessary tools when in-person meetings were reduced because of the pandemic. So, more than three-fourths of global wealth managers see digital transformation as the top priority.

Some trends that we’ve already listed above like cloud adoption, process automation, APIs, and improved customer experience are also relevant for the investment sector. Still, there are some industry-specific trends worth mentioning.

Cybersecurity becomes a high priority

The investment industry collects vast client data and conducts massive financial transactions that make the industry very vulnerable to different cyber attacks. Wealth management firms and banks require strong data security.

Based on the 2020 Banking and Payments Survey, one out of five investors has suffered from financial fraud over the past 3 years. Non-investors, on the other hand, have a lower fraud rate – only one in ten cases.

Among wealth management companies, there are a number of different cybersecurity threats including lack of employee training and awareness, email breaches, impacted vendor’s systems, and so on.

Many investment banks and wealth management companies are experimenting with voice biometrics to increase security and client experience during phone transactions. Among other cybersecurity strategies are advanced encryption technologies like multi-factor authentication or virtual private networks (VPN), electronic signatures, detecting anomalies in network traffic, warnings of possible threats or breaches, content-based identification, and much more.

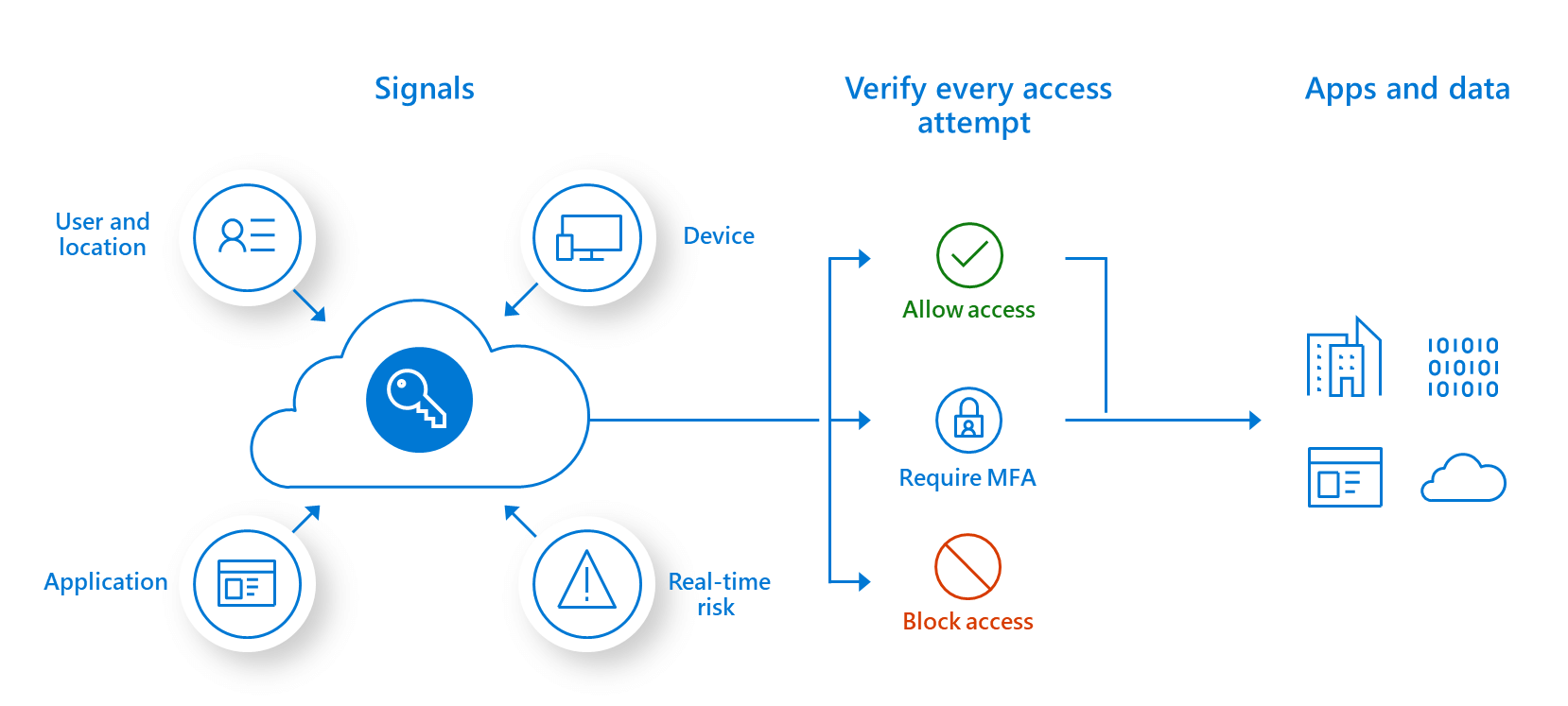

Another important strategy that is gaining traction is zero trust architecture (ZTA) or zero-trust security model. The core idea behind it is “never trust, always verify“, which means that devices should never be trusted by default, even if they are linked to a managed corporate network and have been confirmed earlier. It helps prevent data breaches by eliminating the concept of trust from network architecture.

Source: microsoft.com

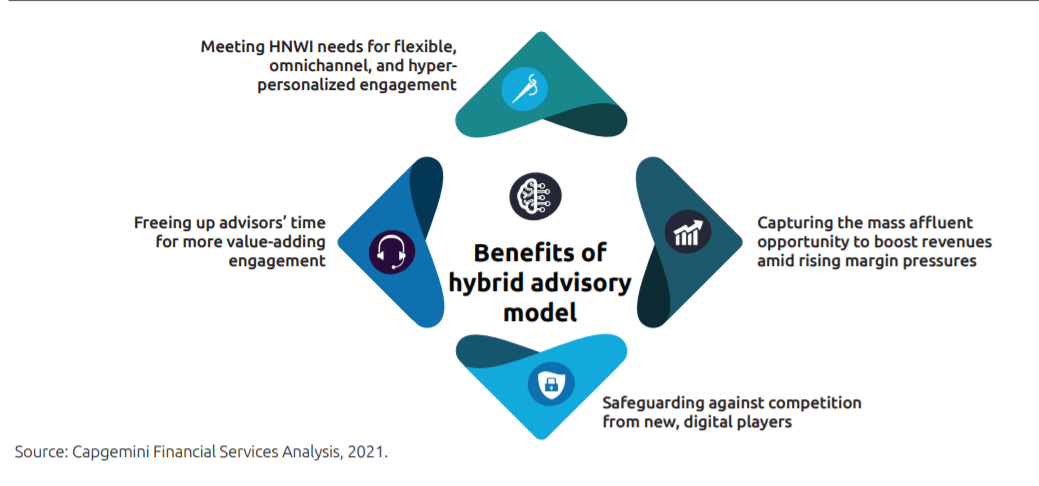

Hybrid advice capabilities

Adopting robo-advisory in the field of wealth management is a good trend across the industry. They seem to be a great option that can lower costs and provide fully automated investments based on self-learning algorithms.

However, it turns out that a large part of the trust in client investments comes from personal relations. Around 54% of investors admit that with a COVID-19-resulted market volatility they have lost trust in using robo-advisors, while 67% investors want digital experience that presupposes interaction with a human advisor.

Hybrid advisory model is a way out. It presupposes that clients are able to make use of digital tools that provide self-investing, as well as human advice on a periodic basis.

Tax and Accounting

Continuous accounting

New technologies like process automation, machine learning, and others are increasingly adopted across the industry to reframe the approach to accounting. That’s become known as continuous accounting.

Continuous accounting is a radical approach to accounting that uses digital technologies to improve the visibility, real-time access, and cost-effectiveness of accounting information. Among the basic principles of continuous accounting are:

- automation of repetitive accounting procedures;

- better workload distribution; and

- change in accounting culture.

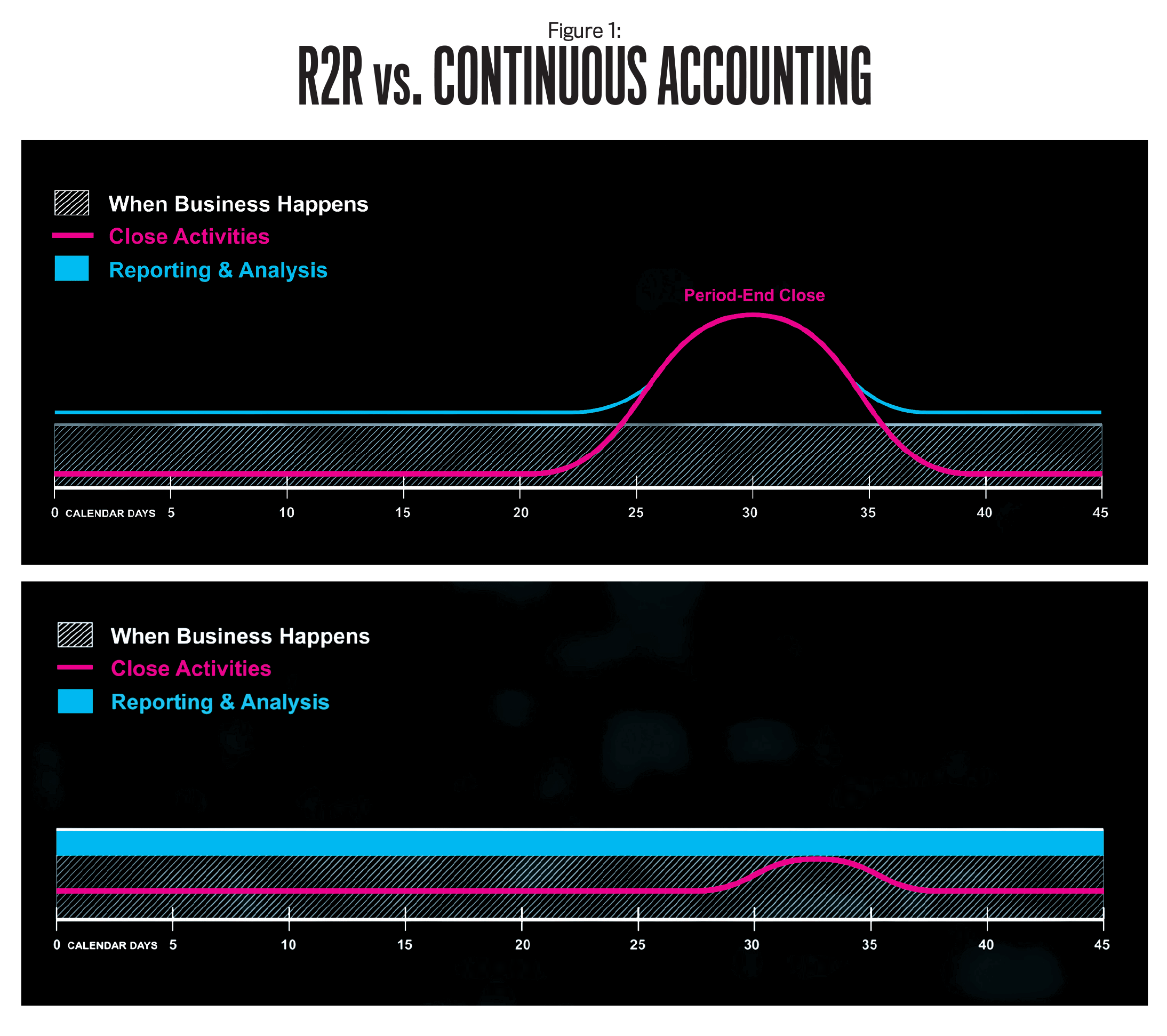

Think of continuous accounting as a real-time Record to report (R2R) process that involves automation, control, and embeds tasks that are normally done at the end of the period into normal day-to-day activities. As a result, the period-end close process is more efficient, the financials are more accurate, and the organization is more effective.

Data harmonization sets a foundation for further improvements

Further growth of the tax and accounting industry and continuous accounting as a trend is impossible without data analytics, which is also a big trend in the industry. Data analytics leverage AI and predictive analytics to solve a number of accounting challenges like financial reporting and forecasts, constant tax law, regulatory, and accounting standards changes, and so on.

The above trends, however, will not be able to reach their full potential without data harmonization. Transactional data must be standardized and combined from different sources in multiple forms, also known as harmonization. Data harmonization is the process of combining organized, semi-structured, and unstructured data into one single system.

Even if you bring all the data together by means of API connections, without unifying and standardizing data types, your data will still be located in disparate buckets. Side-by-side reports are no more useful than analysis in the original tools.

Data harmonization helps to remove ambiguity, link records and establish standards that give a foundational stone for further improvements in terms of data analytics in accounting.

Build your future through digital transformation

The digital transformation in banking and financial services is already happening. This meaning that financial institutions should act now to develop a stronger and clearer vision for how technology can elevate their organizations.

At MindK, we specialize in financial custom software development. We can help you develop financial services digital solutions that securely process complex financial data at high speed, automate business processes, and make banking services more inclusive and accessible to everyone globally.

If you need expert help, don’t hesitate to get in touch. Our managers will get back to you to discuss your challenges and ways to overcome them.