The transition to online reshaped the Fintech industry and gave a huge lift to innovations. Banking became more business-oriented, payment cards gave way to mobile apps, transactions became more “invisible” – and that’s just a small part of how the FinTech industry is evolving.

The popularity of FinTech solutions keeps on growing, and one cannot but take advantage of it. In the UK, for example, using FinTech apps amid the pandemic grew by more than 50%, in Europe this number is 72%.

But what trends are behind the current FinTech growth and which FinTech trends will shape the nearest future finance and FinTech? That’s exactly what we are going to puzzle out now.

MindK, as a company that develops custom software products for the FinTech industry, always keeps an eye on the latest market tendencies. It helps us and our clients build solutions that are competitive, urgent, and up-to-date.

Let’s take a closer look at innovative financial industry trends that are transforming the future of FinTech before our eyes.

5 FinTech technology trends that push the boundaries of financial services

#1 Data analytics is a ground-breaking must-have

Data analytics is a great advantage for almost each and every industry we talk about – real estate, recruiting, or education. It means that working with data is an absolute necessity for any software product that plans to enter the market.

“But the financial sector is probably the most data-intensive one, as it has been operating data for a long while” – you may say. However, using data to provide actionable insight and drive innovation is a whole new thing.

Yes, financial institutions have a considerable amount of data, but the most challenging thing is making the data work toward business growth., Most financial companies are not very good at using these rich data sets due to an unstructured approach to data processing and data silo. That’s why the FinTech sector is considered a frontrunner in investing in Big Data and analytics.

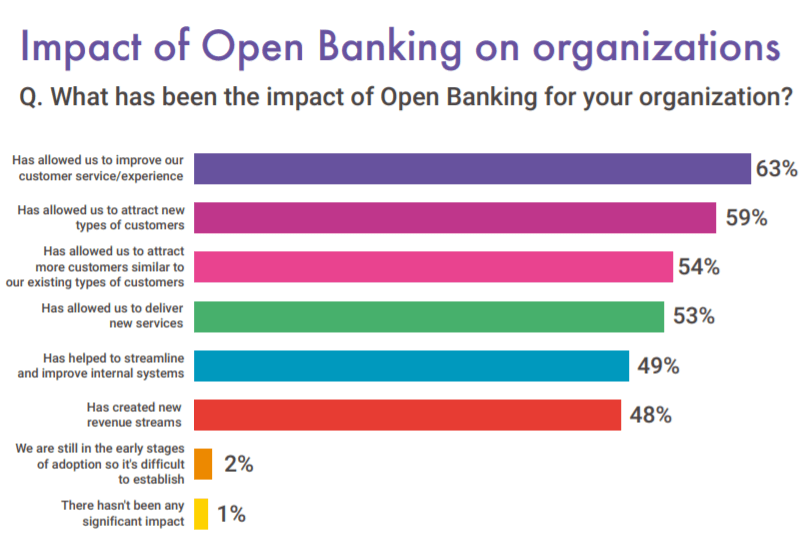

According to the Fintech Futures report, around 86% of survey respondents admit that analytics plays an important role for future success and is a must-have for any technology solution they deploy. Most people consider the benefits of data analytics to be, a competitive advantage, cost savings, winning new customers, and building better relationships with existing clientele, among others.

The urgent necessity in embracing Big Data and data analytics have a number of driving factors including:

- a shift of user behavior towards a more digital customer-centric experience;

- increasing new streams of data due to the rise of advanced and biometric authentication techniques as well as open APIs (we’ll discuss it below);

- a growing competition of Fintech players that use Big Data and analytic techniques for new products and services;

- new regulations (Basel III, FRTB, Know Your Customer (KYC), Anti-Money Laundering (AML) policies and others) force financial institutions to gather data in a controlled way, and based on that collection, automatically generate legally required reporting;

- increased cyber-security;

- a need to reduce operational costs and improve business efficiency at the same time; and

- the necessity to process huge amounts of data in real-time.

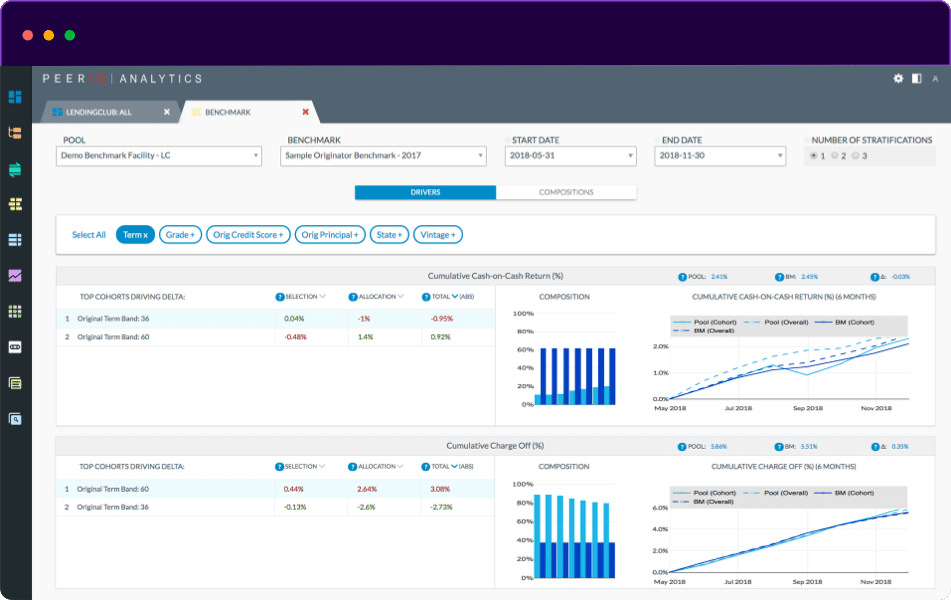

Against this background, a great number of new products have appeared in almost all aspects of financial services from generating reports to predicting and minimizing financial risks. For example, PeerIQ, a data and analytics company, enables risk analysis in the consumer credit market. The platform helps users validate data from different sources, review and forecast cash flow analytics for more solid transactions.

Source: peeriq.com

At MindK we always try to follow industry trends and data analytics is functionality we implement in most of our projects (check out our case studies to make sure).

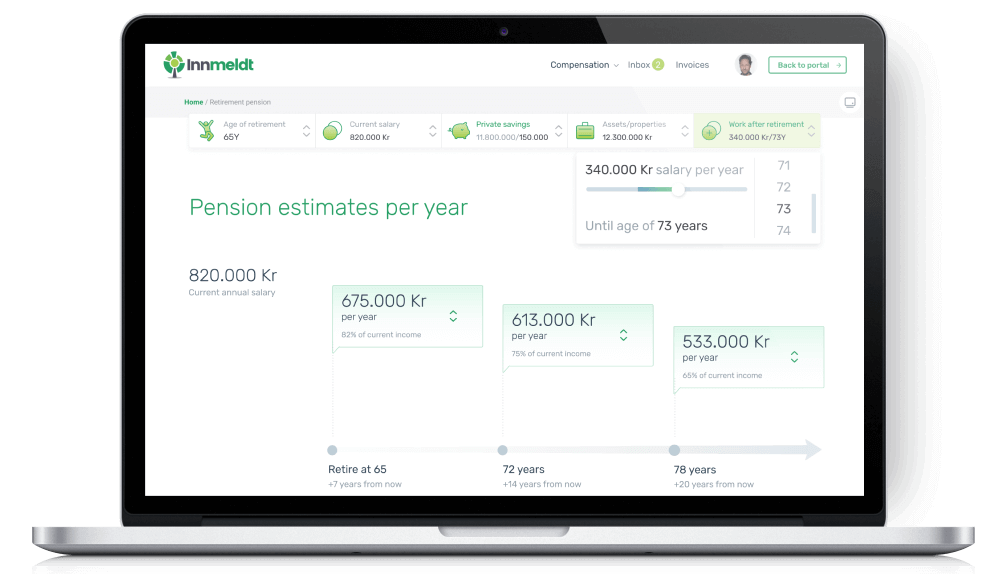

For instance, for one of our projects focused on digitizing pension and insurance calculations for Norway, data analytics helped us make these calculations vivid and transparent for every user. In Norway pension calculations are complex, people must register in several systems and use advanced formulas to find out their pension payments. We built a system where people can get pension and insurance calculations along with estimates within a few clicks.

Review how we helped digitalize insurance and pension consulting

#2 Banking-as-a-Service is taking the stage

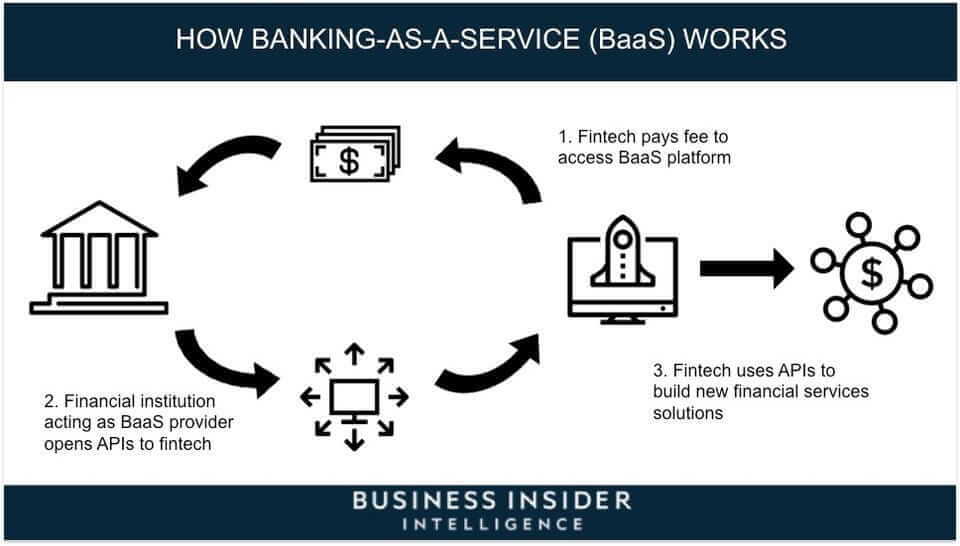

Banking-as-a-Service (or simply BaaS) is the next big thing in the banking industry. BaaS, together with embedded finance (we’ll talk about it later on), refers to an API banking trend. Both are based on using Application Programming Interfaces (API) that allow various pieces of software to communicate with each other.

BaaS is a cutting-edge B2B end-to-end model enabling BaaS providers to provide their banking infrastructure through APIs. The main goal of the BaaS service is to enable FinTech startups to run finance operations and build new financial solutions without organizing their own bank.

The BaaS model resembles renting cloud resources from third-party providers we’ve discussed in our article about cloud computing services and their differences. BaaS allows digital banks and other third-party companies to directly connect with bank systems via APIs to provide banking services to their clients.

There are two main types of BaaS providers:

- pure BaaS providers, FinTech companies that offer a BaaS functionality that help their clients provide banking services; and

- traditional banks that opened their banking infrastructure and licenses to other FinTech players by means of APIs.

Here is how the BaaS model works – a FinTech company pays a fee to access the BaaS platform. The BaaS provider opens APIs giving access to its infrastructure required to build new FinTech solutions.

This way, the company with such access may provide a set of different digital banking services to its clients, including payment processing, card issuance, creating bank accounts, balance checks, history views, and much more.

For example, solarisBank is a pure BaaS provider that provides APIs to integrate digital banking services directly into different products.

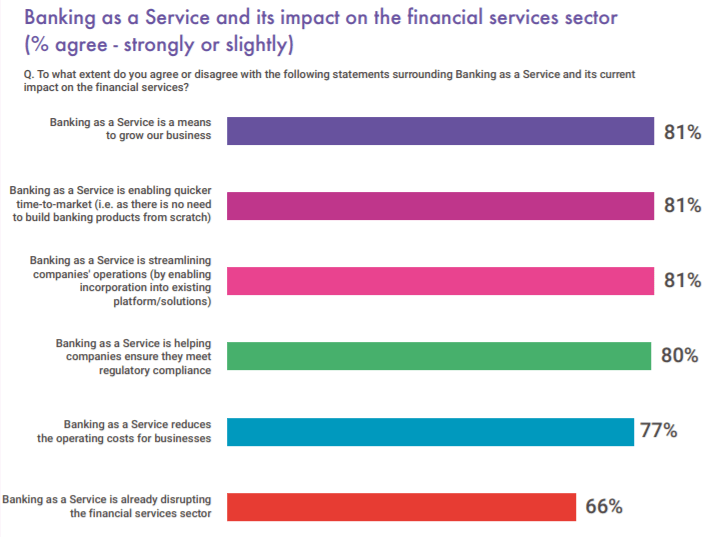

BaaS is also among FinTech hot topics and a real game-changer for the financial sector. According to the Financial Services State report by Finastra, Banking as a Service will have a major impact on 85% of global financial institutions. Most respondents agree that BaaS has a number of benefits, like faster time-to-market, streamlining company operations, meeting regulatory compliances, reducing operational costs, and others.

So, if you plan to enter the market with an innovative FinTech solution, this is definitely a key FinTech trend you should pay closer attention to.

#3 Financial services are becoming embedded

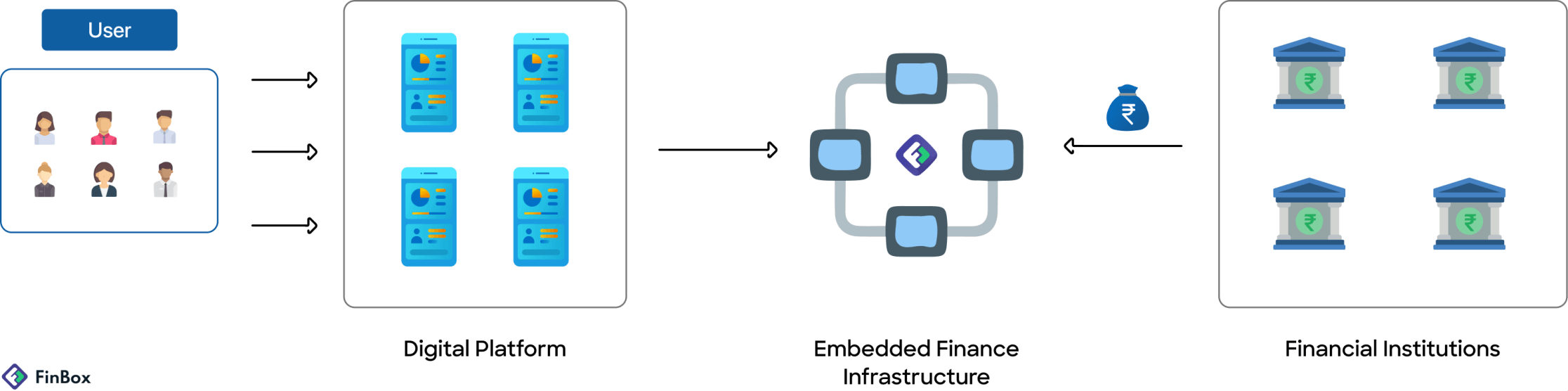

Providing banking services in a seamless way without users noticing it is a new superpower of data-driven FinTech solutions. This refers to embedded finance which is now one of the hot topics in the FinTech world.

Embedded finance allows integrating payments, loans, insurance, and even investment instruments into almost any non-financial service or product. For example, you can obtain a credit directly in an online store without the need to go to a bank or fill out any forms.

The idea behind embedded finance is simple and involves four major players: user, digital platform, embedded finance infrastructure, and financial institutions represented by banks, small finance banks, and non-bank financial companies (NBFC) like insurance, currency exchange, microloan organizations, etc.

Here is how embedded finance works – a user goes to a digital platform that may be a mobile, web, or desktop application. This platform has a necessary Software Development Kit (SDK) or API provided by an Embedded Finance Infrastructure company which makes financial services like credit, insurance, or similar, available right in the app.

An Embedded Finance Infrastructure organization, in turn, acts as a bridge between financial and non-financial companies bringing value to both.

Source: linkedin.com

There are a number of examples of this “invisible” finance service:

- embedded payments exist in ride-sharing apps like Uber and Lyft, coffeehouse Starbucks, and others that allow in-app payments;

- embedded lending, such as Klarna and AfterPay that allow splitting an online purchase into several monthly payments;

- other types of embedded finances like embedded investments and embedded insurance.

The embedded finance concept captures the moment when a user has an urgent need and converts them into a customer. No wonder the embedded finance forecast looks so promising.

In the next few years, using the embedded finance model is expected to allow traditional banks to save costs on marketing and branding and digital apps to increase revenue per user by 2-5x.

#4 Open banking is gathering speed

Open banking, also called “open bank data”, allows banks to provide access and control of client banking transactions and financial data to other companies via APIs.

But what’s the difference between open banking and API banking if both enable API integrations?

At first glance, the difference is not evident thus people often consider it the same thing. The devil is always in the details, which is exactly the case here – the main difference is how they use Application Programming Interfaces.

Banking-as-a-service uses APIs to provide different types of banking functionality. Open banking, in turn, allows accessing consumer data (with their consent) by means of API without transferring banking functions.

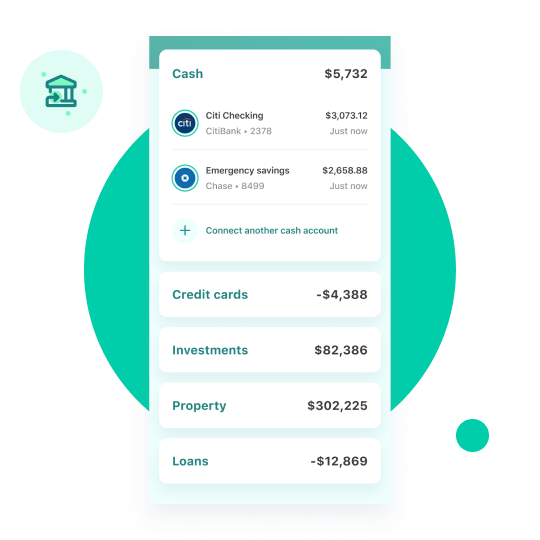

To understand how open banking operates and differs from the Banking-as-a-service model, let’s review an example of financial apps that help plan the budget, analyze spendings, and optimize economic behavior.

Typically, such applications are not banking products and they also don’t allow the issue of a debit card, make deposits or apply for a loan right in the app as API-banking-based apps do.

Instead, they enable collecting real-time financial data from multiple finance accounts, ascertaining credit score ratings, reviewing transactions, and similar. In short, they enable people to get a more detailed view of their current financial situation based on the real data from their bank account.

A great example of this is Mint, a personal finance management system that uses the information from bank accounts to help people track spendings.

Source: mint.intuit.com

When MindK built a feature-rich system for better pension and insurance calculations (that we discussed above), we developed complex API integrations with Aksio and Norsk Pensjon insurance systems that always provided up-to-date data for calculations people made in the system.

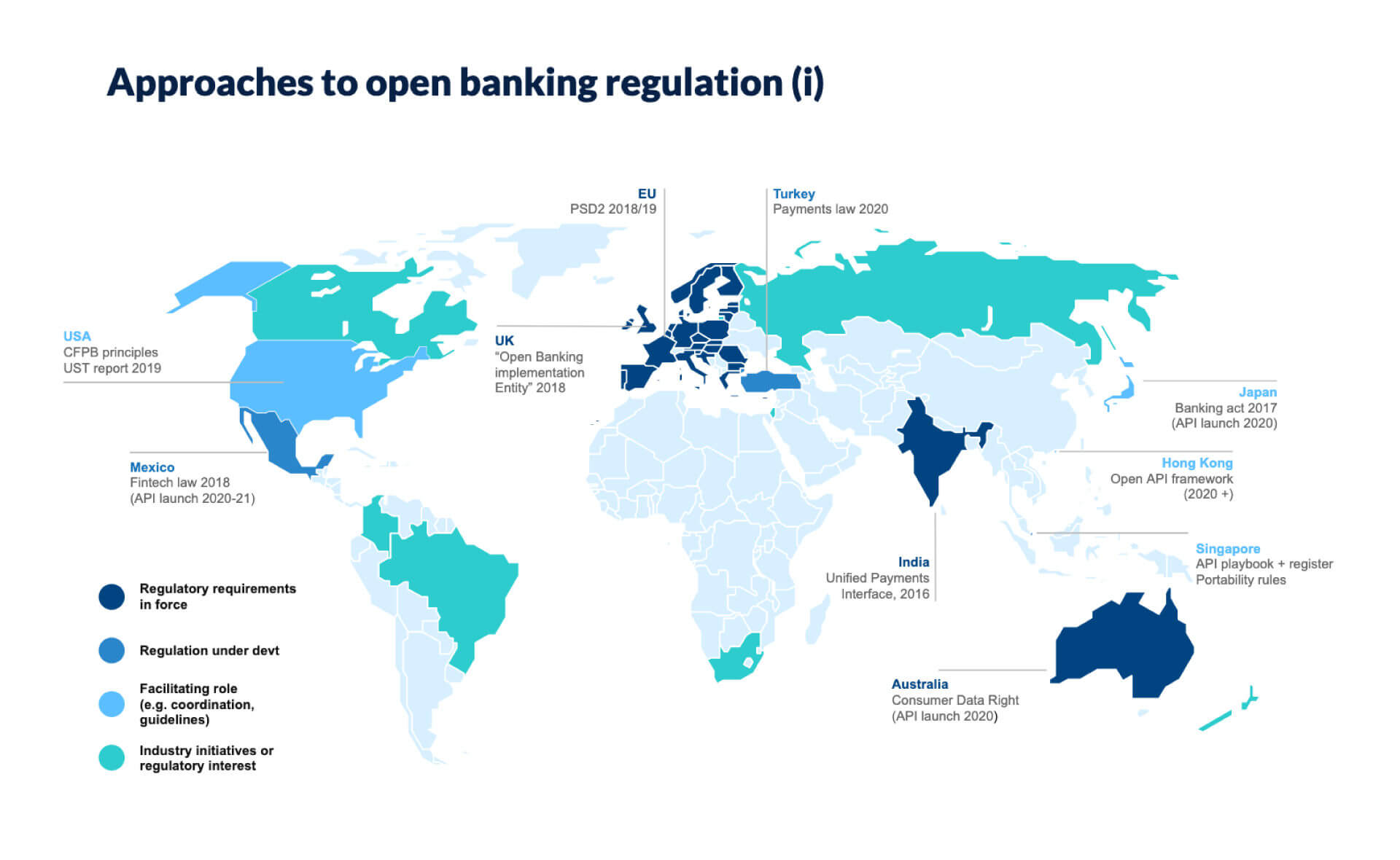

The trickiest thing about open banking is regulations. The regulatory landscape differs depending on the country. In most regions, rules regarding open banking are in varied stages of development, while in others there are clearly defined laws towards it.

The United Kingdom, most countries in the European Union, and Australia for example, are early adopters of approved open banking environments. They have transparent regulatory laws like the Payment Services Directive (PSD2) from 2018 in Europe, Open Banking Standard from 2018 in the UK, and Consumer Data Right from 2020 in Australia that allows third-party companies to access bank data more easily and securely. The USA, on the contrary, lacks unified open banking regulations.

Source: bbva.com

We at MindK are sure that the adoption of open banking regulations will likely continue in the near future due to increased focus on competition and innovation in the FinTech sector. Additionally, such regulations will definitely encourage digitalization and FinTech development in response to the global pandemic recovery.

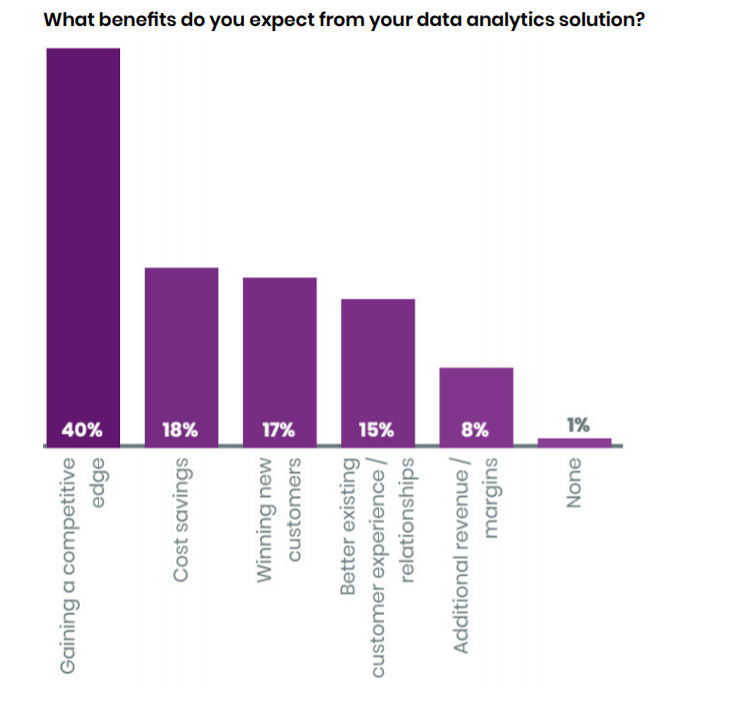

Around 97% of companies that have already adopted open banking admit that it has

brought value to their business. Among the benefits, they report improved customer service, ability to deliver new services and generate new revenue streams, and better customer engagement.

Source: finastra.com

#5 Digital payments have already captured the hearts

The pandemic has served as rocket fuel for various innovations in payments. In a search for better convenience and security, people become more eager to try different payment methods. 56% of global consumers admitted they tried a new local payment method during the pandemic.

As a result, MasterCard, for example, observed a 40% increase in contactless payments in the first quarter of 2020.

Payment innovations in the Fintech sector involve a number of components like contactless, mobile payments, identity verification tech, and so on.

Contactless and mobile payments are valued for their speed of transactions, convenience, and better security. More and more people tend to use biometrics (like fingertip, facial recognition, eye scan, and similar) to protect their payments and mitigate many of the worries connected with payment fraud.

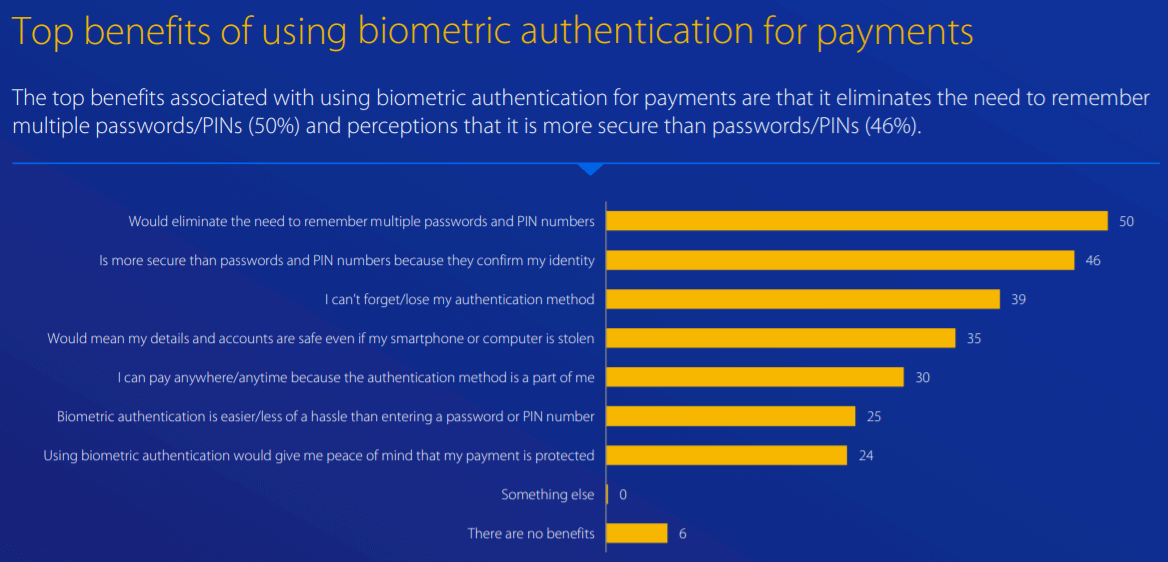

Visa’s survey proves this fact. The survey revealed that around 86% of respondents are interested in using biometrics to verify their identity or make payments. The main reasons for this are not remembering too many passwords and trusting in the secure nature of biometric authentication.

Ready to develop an innovative FinTech solution?

There you have it – five powerful trends in financial services that are already disrupting all the aspects of financials. As you can see there are a number of technological and regulatory innovations that actively drive the changes in the financial sector.

It means that those businesses able to embrace the latest trends in finance to benefit their FinTech solutions will lead the market. Knowing the market and trends is a must to start your FinTech company in 2021.

If you’re looking for a reliable development company to make your ideas come true, MindK team is ready to help you with that.