The education sector is quite conservative and has been slow in adopting new technologies. However, things are starting to change. The global Edtech landscape is developing by leaps and bounds and requires businesses to adapt on-the-fly.

At MindK we build custom software products for more than 10 years and know that developing every digital product should start with 360-degree market research. The education industry is no exception. Read on to understand the Edtech landscape, find out about the market leaders, and discover what drives growth in Edtech.

Let’s dive in.

3 key factors that are driving EdTech

Investors and companies in the field of education are recognizing the key global macro trends that will keep on driving growth and innovations in this sector:

#1. Post-COVID-19 funding slump

Following the recent cost of life crisis, the funding has dropped significantly. 2022 brought EdTech companies just 1/2 of the investments the year before. In 2023, education startups are estimated to have snatched about $3.5B without a single company braking the $100M ark.

This makes it challenging for new players to attract attention and grow their business. Still, the global market is expected to grow at at steady 13.6% CAGR from 2024 to 2030. It means that EdTech startups will have to get creative, optimize costs with low-code development and outsourcing, as well as innovate boldly to grab a piece of this $348.41B opportunity.

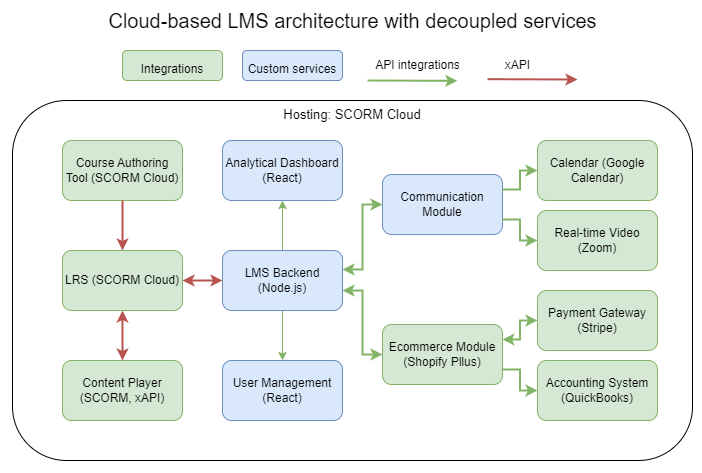

Example 1: A platform-based approach to LMS development combines readymade solutions, API integrations, and custom features to cut costs and improve development speed.

#2. Global education challenges

Like any other traditional industry, the education sector is full of challenges. However, where there are the challenges, there are also opportunities (check out our previous article on EdTech challenges and opportunities).

Accessibility, the cost of higher education, the quality of learning in remote settings, corporate learning – these are just some problems that technology startups can help solve.

By tackling these problems, you can drive change and create opportunities for all businesses in the industry.

#3. The AI revolution and digitization trend

Since the release of ChatGPT, both students and EdTech starups have been scrambling to find new creative uses for AI.

Together with digitalization, AI helps us reduce manual processes, improve results and be more efficient. While its effects on primary and higher education are still up in the air, AI has became a backbone for many educational apps:

- Chatbot tutors and on-demand support.

- Personalized and adaptable learning.

- Automated assessment of assignments.

- Granular analytics for teachers and product owners.

- AI-based educational games.

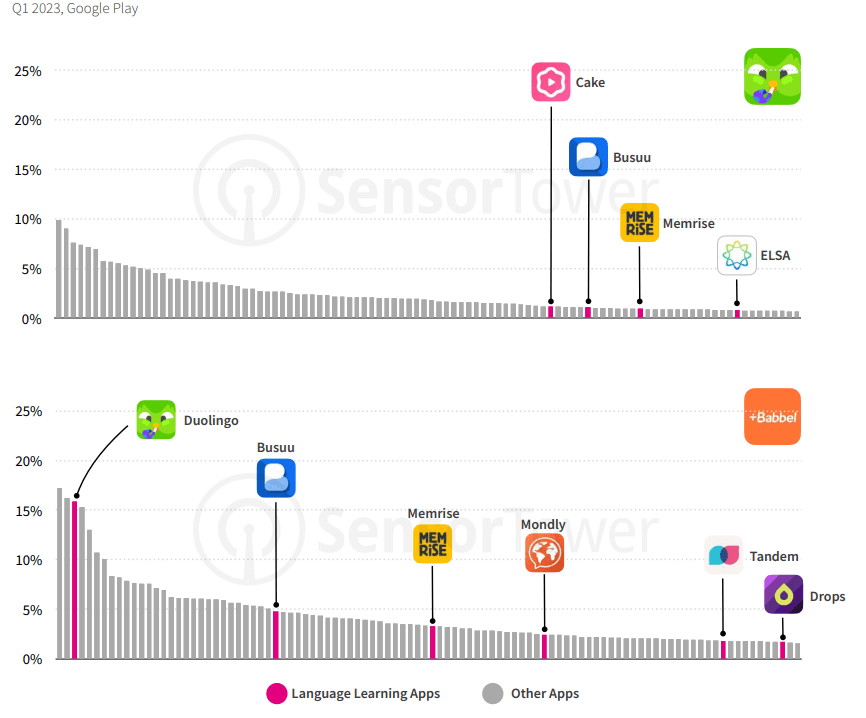

Take for example, Duolingo, which uses AI to analyze the user’s learning habits to offer highly tailored programs. AI represents a huge threat to language learning apps. Yet great gamification helped Duolingo build a protective moat that helps the app retain and grow its userbase in the age of AI.

Global Edtech landscape at a glance: what does it include?

Most people often associate EdTech only with online learning. But in fact, it’s a huge industry with vast opportunities.

Education technology is not only online learning, but the whole suite of digital products, hardware, tools, and services that are created to reach educational goals.

This particular variety may lead to some confusion for those who want to understand the EdTech opportunities.

So, if you independently decided to gather a complete picture of the global elearning industry, you would likely need a lot of hours (if not days) of research.

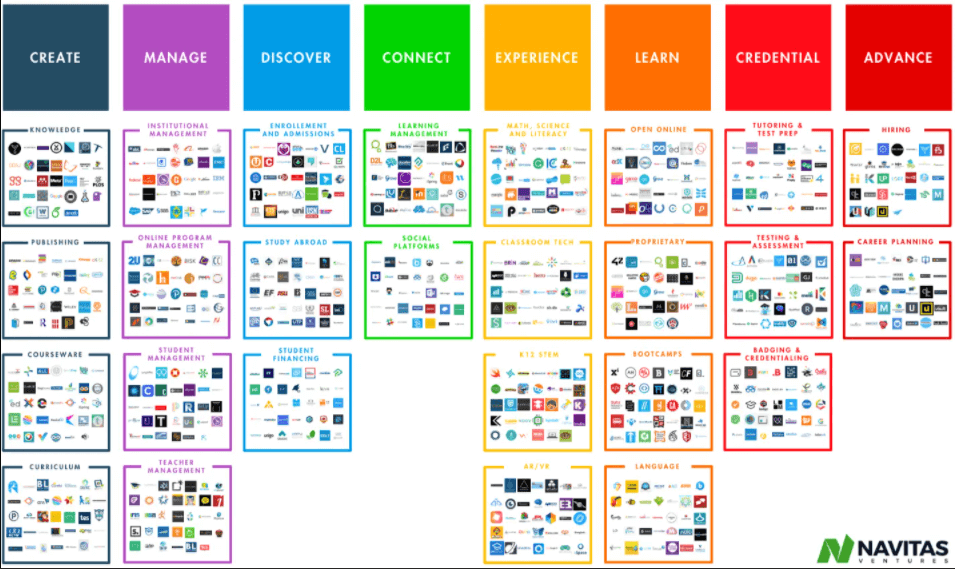

The good news is Navitas Ventures, an education venturing arm of Navitas, a leading global education provider, has done this research for us. Not long ago they published Global EdTech Landscape 3.0 that represents an all-embracing EdTech map covering the emerging landscape of innovations and technology on the global education technology market.

Navitas Ventures analyzed around 15,000 EdTech companies and found out that most of them have similar technology, business models, or areas of education. Based on these similarities, they grouped companies into 26 clusters, then logically divided clusters into eight steps, namely Create, Manage, Discover, Connect, Experience, Learn, Credential, Advance.

These steps were called Next Generation Learning Lifecycle.

Their EdTech report is quite massive (and you can grasp it by yourself for more detailed info), so we will try to single out the essence and review characteristics of each of these steps and their elements.

Create. This section refers to everything from the creation of learning content to courseware and knowledge curation, and involves four foundational clusters:

- Knowledge & Research that draw together educational social platforms such as Academia.edu and ResearchGate, EdTech tools for searching like Sparrho, Microsoft Academic, and Google Scholar, platforms to manage and share research papers like Mendeley.

- Publishing & distribution with a focus on online publishers and rental apps allowing content publishing and sharing.

- Digital courseware meaning electronic learning content that can be delivered either standalone or via a learning management system (EdCast, Discovery education, etc.).

- Curriculum & lesson plans received a new way of improvements – EdTech startups are now focused on bettering the collaborating, mapping, and designing new types of curriculum. Examples include Mystery Science, LearnZillion, VidCode, and projects such as SolarOne’s Green Design Lab.

Manage. It refers to learning management technology that is aimed to drive efficiency across operations, staff, and students. Logically it involves institutional management, online program management (like FutureLearn, etc.), student management (also called Student Information Systems), and teacher management.

Discover. It is related to emerging technologies that expand the opportunities of international learning pathways (like Fulbright program, ERASMUS, and the New Colombo Plan), as well as student financing and easy enrolment and admissions.

Connect. The motto of this section is “learning gets social”. It unites various digital tools that enable learners to connect with tutors, study resources, and other people. It includes a wide range of Learning Management systems (LMS) that connect students with content in a structured way, and social platforms focused on connecting learners with each other. The process of developing a feature-rich LMS system is rather smooth and is described in our atricle on how to develop LMS without lossing money and one’s mind.

Not long ago, our company built a Learning Management System and Marketplace for an ambitious startup from Luxembourg. The main goal of the system was to bring together the best trainers, large companies, and individuals in one place. We created an easy-to-use platform Tyoch that provides coaches with everything to run their education business online.

Experience. This section takes into account new channels that engage learners in the educational process, challenging them to think and solve problems in new creative ways. For example, classroom technologies, as well as virtual reality and augmented reality are actively used for gamifying the learning process and bringing science to life.

Learn. This segment is really huge and involves:

- Open or proprietary online platforms, including such Massive open online courses (MOOCs) as Coursera, Udacity, edX, Udemy, etc,

- Bootcamps which represent short programs ( from 9 to12 weeks) focused on teaching digital, technical, or other career-focused skills, and

- Language learning platforms like Duolingo, Babbel, Busuu, Liulishuo, and others.

Credential. Along with new ways of learning, there are new ways of evaluating skills and knowledge. This cluster unites various test prep and assessment apps. The great thing is that such solutions are very helpful in industries beyond EdTech like HR & Recruiting. For example, PyMetrics apply neuroscience games for assessing personality characteristics, making career suggestions, and filtering job applicants.

Advance. It gathers all the platforms that help learners realize their goals and ambitions at work including career planning and hiring & internship systems. They range from all-embracing career advice web portals such as The Muse to industry-specific platforms like Mergers & Inquisitions, a resource for aspiring financial experts.

Aside from this global education map, you can also get acquainted with The 2021 Global Learning Landscape, published by HoloIQ. It is a systematic classification dedicated to EdTech industry overview and innovations happening in this sector. Their taxonomy is very similar to the Global EdTech Landscape, but has a slightly different cluster classification.

The output is quite simple: the spectrum of EdTech software products is so broad that in spite of competition in each of the clusters, it demonstrates a great potential for businesses. Especially today, when the investments in education technology are hitting record numbers.

To help you see the bigger picture of the current state of the market, we gathered information about the countries that are leading today’s EdTech.

Сurrent state of the global EdTech

The EdTech market size was expected to grow rapidly (by 16% annually), but not equally in all countries. That is because many developing countries are moving very slowly in this direction, while in developed countries the growth is too speedy.

China

Chinese education technology market leads the world. It attracts investors because it’s developing actively and consistently.

Its growth began in 2014, and in 2019, 40% of global venture capital deals in this segment fell on companies from Сhina. The leaders in Chinese EdTech provide solutions for school curriculum and English learning.

In 2020, the Chinese market demonstrated the largest deals thanks to top education innovators: Yuanfudao, a platform for live courses and tutoring, raised $ 1 billion in March, followed by Chinese startup Zuoebang, an AI-powered platform for primary and high school, which raised $ 750 million in June.

India

The EdTech market in India didn’t exist until recently. Everything changed in 2018 when it became most attractive for international investors due to the spread of smartphones and openness to foreign investment.

In the third quarter of 2020, Indian companies raised around $ 1.6 billion and took second place in the world in terms of investments, thus outpacing the United States.

Last year, Indian education tutoring app Byju became the first EdTech “Decacorn” worth over $ 10 billion.

The USA

In the USA, the main niches of the EdTech industry (secondary and higher education) have already been covered by unicorn companies.

For now, the American market includes more than 2,000 EdTech tools and products.

This is why businesses are forced to compete with each other by means of new technologies and services (AI-based solutions, deep data analytics), and by entering new segments like liberal arts and edutainment (educational entertainment) with an emphasis on culture and art.

Latin America and Asia

The EdTech market is expected to grow in Latin American and Asian countries where traditional forms of education are out of reach to a large number of people, due either to remoteness or cost.

Last year, a Brazilian company Sanar, which provides online training for healthcare workers, raised around $ 11 million to develop its platform. Their success was likely driven by the fact that they turned out to be on the borderline of two hottest topics – online education and healthcare.

As of January 2021, there were 19 EdTech unicorns in the world that have collectively raised more than $13.7 billion of total funding in the last decade. Among them, 8 are from the USA, 8 from China, 2 from India, and 1 from Canada.

All these statistics help us conclude that the pandemic gave a new life to online education. But how long will this growth last?

Speaking about future EdTech…

Global Education Outlook Survey by Holon IQ set up a goal to discover how global education executives (namely, Ministers, Presidents, CEOs, Senior Executives, and Investors across the full spectrum of public and private institutions and Edtech companies) feel about the future of e-learning.

Their opinions were divided.

Half of the respondents expected a downturn in the short term, while the other half predicted a positive impact of post-pandemic recovery or no change.

Nevertheless, analysis of the present-day situation allows us to make some takeaways which entrepreneurs in the EdTech industry should take into account:

- Growth of e-learning is highly dependent on infrastructure.

According to a report of UNICEF and the International Telecommunication Union (ITU), two-thirds of the world’s school-age children (or 1.3 billion children) have no internet connection in their homes. This causes certain doubts about the further rate of technology adoption in schools and universities, as well as whether the pandemic will further motivate learning institutions to use EdTech tools on an ongoing basis.

Hence, the technology adoption not only depends on EdTech companies but requires a complex workover of both the state and market participants.

- Most people have improved their digital competence thanks to the pandemic.

During the coronavirus lockdown, lots of people started using online tools for education such as cloud storages, video conferencing services, LMS platforms, etc.

Now a lot more people have become potential consumers of EdTech software, increasing the volume of the market. We should definitely feel the impact of this factor in the coming years, not only in Edtech. People will be more likely to use technologies in other spheres of their lives.

- Rapid adaptation has never been more important.

The current business environment shows us that the one who quickly adapts wins. In response to the fast-changing world, many companies began to dramatically increase their capacity, automate their business processes and even change their business models.

The ability to adapt promptly and navigate high uncertainty is a challenge for many businesses. Our company MindK together with partners from Radenia AG organized a webinar where we discussed how businesses can develop solutions or automate business processes in times of pressure and budget constraints. We wrapped the speech into an easy-to-follow guide to digital transformation for those who are interested in facing the new normal with a ready-made strategy.

- Sooner or later, the educational system will integrate EdTech.

Most learning processes will become automated. However, for now in many countries, there is competition among solutions for additional adult education, while the segment for schools and higher education is very poor. It means that startups need to better embrace the academic world.

Final thoughts

The rise of the Edtech market is a great opportunity for both existing businesses and startups.

If you gained the absolute impression that all the seats on the train leaving for a bright EdTech future have already been taken, this is completely untrue.

Sure, there is competition because of rising demand, but it will undoubtedly stimulate the market to become more technology-savvy.

This is why entrepreneurs and startups should look towards interactive digital solutions and new technologies that change not only what we learn, but how we learn it.

To make it more comprehensive, we highly recommend you check out our complete guide on how to start an EdTech company.