Solve real problems and empower product-led growth

Embedded finance software development

Integrate financial and banking services into products that people use daily. From selling insurance in real estate marketplaces and healthcare apps to ‘buy now, pay later’ options in e-commerce stores, embedded finance is adding value across industries and niches.

Mobile banking app development

Meet the growing demand for remote banking services by building an application that lives up to customers’ expectations. We help neobanks and traditional institutions innovate to raise customer satisfaction.

Insurance software development

Allow insurance agents track commissions, manage tasks, process claims, do reporting, create invoices, make payments, and automate other administrative tasks using cloud-based solutions or mobile apps.

P2P lending software development

Build and launch a peer-to-peer lending or debt crowdfunding platform that automatically matches borrowers with investors. Our fintech development services help you build robust risk assessment functionality to make accurate credit decisions.

High-frequency trading software development

Enable users to identify profitable opportunities and place trades to generate profits fast. We develop financial software for crypto and stock trading, making it possible for the information flow to move in real time.

Mobile payment app development

Optimize splitting bills, sending remittances, exchanging foreign currency, and transferring money across borders. We build mobile payment apps with wallet features that make sending and receiving money quick and easy.

Personal finance app development

Develop a budgeting app that helps people manage their finances, track spendings, and provides useful tips on how to manage money better. MindK creates personal finance apps that link all the user’s bank accounts together.

Investing app development

Create a platform that helps people get into investing. We design and develop user-friendly applications that offer a variety of affordable funds to invest in, trade, and stay updated on the market trends.

AI agent development

Build secure RAG-based AI agents with built-in protection against harmful actions. Analyze account activity, spending patterns, and market data to deliver real-time recommendations, cut manual fraud case review time by 60%, and more with our AI agent development services.

Overcome key challenges in fintech app development

Fintech isn't the easiest industry to target. But with a trusted fintech software development company, you can overcome its major technical challenges.

- Regulatory compliance

- Sensitive data protection

- AI development & integration

- High-speed data processing

- Advanced analytics and risk management

- Blockchain-based fintech

- Engaging customer experience

- Continuous delivery & automation

- FinOps and cloud cost optimization

- Open Banking API integration

Case studies in fintech software development

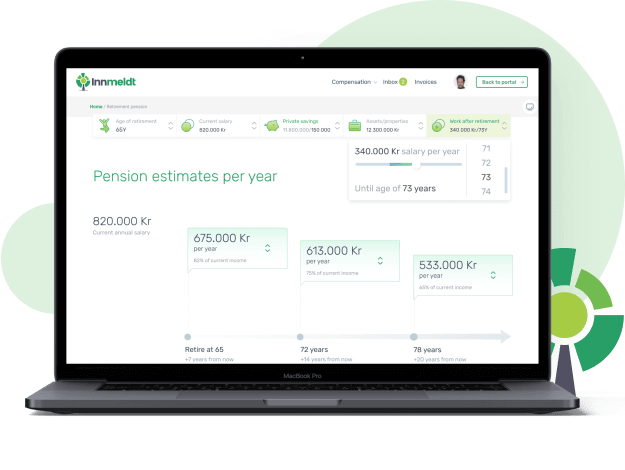

Pension and insurance consulting for 300K+ users

Innmeldt is an insurance consulting agency that works with the human resource departments of top Norwegian companies. They needed a platform that automates calculations for one of the most complicated pension systems in the world, allowing Innmeldt to better serve more customers.

We helped legacy consultants adopt the B2B2C SaaS business model with a modern web application. It allows Innmeldt's customers to see the exact amount of retirement and insurance payments. The web portal can be customized for each company Inmeldt works with. It runs on top of a custom management system that we integrated with Aksio and Norsk Pensjon insurance systems for up-to-date data. This solution allowed Innmeldt to onboard 13 enterprise clients with 300,000+ individual users.

Designing an energy trading platform

Our client is a Swiss-based energy trading marketplace that turns LNG & H2 into tradable and hedgeable commodities and offers real-time physical and financial trading, risk management, portfolio optimization, price discovery, and market analytics.

We helped our client design its trading platform. Some of the major functionalities we designed include a tender creation wizard and a dashboard that provides a quick overview of available trading options and market analytics.

What

our

clients

say

Why MindK

Start fintech software development with MindK

Let us know about your challenges and within 24 hours

we'll schedule a free consultation with our CEO.

Frequently Asked Questions

- How do you handle scaling and performance as the user base grows?

Scaling is key in fintech software development due to high transaction volumes and real-time data processing. Our systems are often designed using microservices architecture, so individual components can scale independently. This minimizes bottlenecks and load distribution.

Cloud infrastructure allows adjusting resources on the fly and guarantees smooth performance during peak demand. Performance testing and load balancing also play a big role in keeping the system reliable and fast as the user base grows.

- What fintech regulations do you follow in different regions?

We incorporate a comprehensive legal and regulatory review in the initial phases of fintech product development. The team ensures software complies with standards like PCI-DSS for payment security, GDPR for data privacy in EU and CCPA for data protection in California.

We also integrate KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols to meet global regulatory requirements. The last element is working with legal experts to ensure software follows fintech compliance regulations across multiple jurisdictions.

- How do you ensure data privacy and protection during development?

We have a multi-layered security approach that includes data encryption, secure API development, and strict access controls. Security is integrated from the early stages of fintech software development, following principles like the Secure Software Development Lifecycle (SSDLC).

Regular security audits, vulnerability scanning, and penetration testing identify and resolve security gaps. We ensure sensitive financial data is protected both in transit and at rest, following best practices in cybersecurity.

- How do you integrate with existing financial systems?

Integration is a challenge in fintech due to legacy systems. We do a thorough system audit to understand the existing infrastructure and identify integration points. We use middleware solutions and APIs to ensure seamless data exchange between old and new systems. This minimizes disruption, supports real-time data sync, and allows businesses to upgrade without having to overhaul their existing setup. Compatibility and extensibility are always prioritized to future-proof the solution.

- Do you provide support after fintech software development?

Yes. Our fintech software development company provides routine maintenance, new feature updates, and security patches. We also do performance monitoring to detect and address issues before they affect users.