Choosing the perfect payment system for your web application can be a nightmare. While mobile apps can get away with in-app purchases (for a monstrous 30% AppStore cut), web applications need a payment gateway to accept money from their users.

And this is where things get complicated.

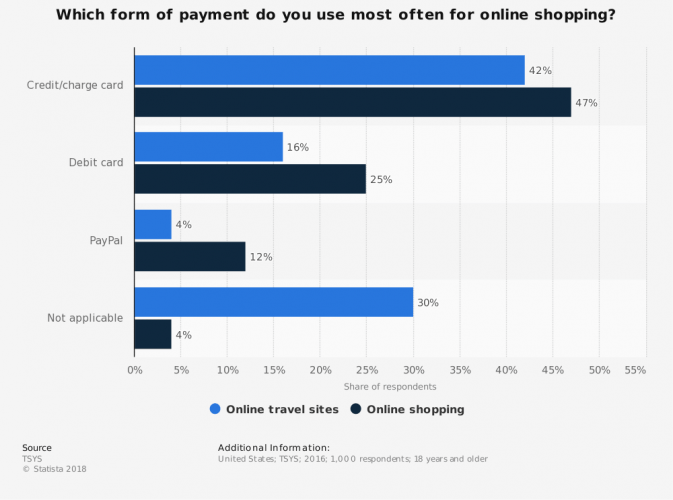

50% of online shoppers will abandon their carts if your app doesn’t have their favorite payment method. But there are more than 70 payment systems out there! Each has different terms (read the fine print!), fees, and features.

Aa a Fintech software development company, MindK has integrated numerous paymented gateways, local and global payment systems. Today we’ll compare three popular gateways (Stripe vs. PayPal vs. Braintree) to make your choice a bit easier.

Table of contents:

General overview

PayPal

Once an eBay subsidiary, PayPal has become the world’s most recognizable payment system. Twenty years after its foundation, the gateway processes 7.6 billion transactions from 227 million accounts. 17 million merchants trust the system with their sales online. Among its clients are eBay, Walmart, Best Buy, and Netflix.

PayPal is a great choice for startups and small vendors as it pools money from all its merchants into a single aggregate account. This means that PayPal isn’t so picky about approvals as major banks and won’t reject you because of a short credit history. Moreover, the whole approval process usually lasts no more than 3-5 days.

Still, a lot of enterprises use PayPal as an extra option since 12% of Americans name it as their favorite method of payment.

Integrations: pretty much any platform.

Supported currencies and countries: 24 currencies and 200+ merchant locations.

PayPal accepts major credit/debit cards (American Express, MasterCard, Visa, and Discover), PayPal, Android Pay, Apple Pay, and Bitcoin.

Contractual requirements: none; you can terminate at any time free of charge.

Just remember that you won’t be able to take the customer data with you!

Payout: 1-4 days; Instant Transfer for $0.25.

Unlike other gateways in this article, PayPal’s offers three different plans:

A basic gateway you can set up in under 15 minutes and start accepting payments right away. The payment integration is incredibly simple and requires no technical expertise (although you can’t customize the checkout).

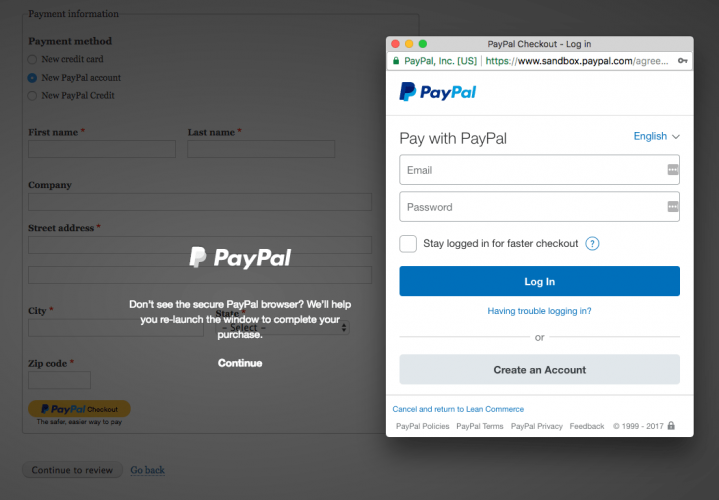

The gateway redirects buyers to PayPal’s website freeing you from the majority of PCI DSS requirements. However, this might cost you some conversions due to the interrupted flow.

An excellent choice if you already accept payments online and want another option for your users. Customers enter their credit card details in a secure window that overlays your site. Once the transaction is complete, the gateway returns users to your app. PCI requirements and fees are similar to PayPal Standard.

Unlike other options, PayPal Pro keeps users on your website. The result is a smoother, fully customizable experience. You’ll have to handle PCI compliance yourself but transparent redirect makes the task a bit easier.

How Paypal Checkout looks in a web app

Stripe

Stripe payments was the first gateway with well-designed APIs, which continues to introduce innovative features. The company has become one of the most trusted payment systems in the world with its value reaching over $9 billion.

According to Stripe, 27% of Americans have used it to make a purchase in 2015.

High-profile clients: Target, Lyft, Pinterest, Kickstarter, and others.

Integrations: Bigcommerce, Shopify, WooCommerce, Magento, Spree Commerce, etc.

Supported currencies and countries: 135+ currencies and 25 merchant locations including US, Canada, Australia and most of Europe.

Stripe accepts most US debit/credit cards and American Express, Visa, and MasterCard for international payments. It supports Android Pay, Apple Pay, 3D Secure, ACH and even China’s Alipay. Until recently, the gateway accepted Bitcoin but that is no longer the case.

Contractual requirements: none; you can terminate at any point free of charge.

Stripe will even help you migrate user data if you leave the gateway.

Payout: 7-days for the most countries (2 days for Australia/US, 4 for New Zealand); Instant Deposit for 1% fee.

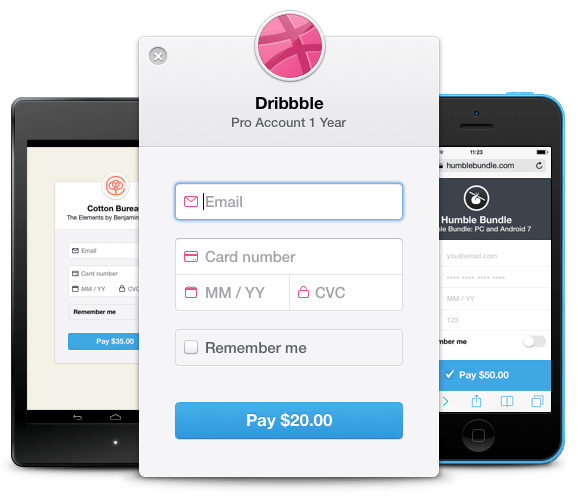

How Stripe checkout forms look

Braintree

Braintree was founded in 2007 with the aim to bring outstanding customer service to the payment industry. In 2013 PayPal bought the company for an impressive $800 million. Since then Braintree has become one of the major players in the market processing over a billion transactions per quarter.

Unlike PayPal and Stripe, Braintree provides dedicated merchant accounts.

The gateway uses the same UI as PayPal and Venmo making it instantly recognizable.

High-profile clients: Uber, Airbnb, Casper, Marketplacer, etc.

Integrations: BigCommerce, WooCommerce, yodel, Magento, 3dcart, Salesforce, etc.

Supported currencies and countries: 130 currencies and 45+ merchant locations including US, Canada, UK, and Australia.

The gateway accepts major credit cards, PayPal, Venmo, Android Play, Apple Play, ACH, Union Pay, as well as Bitcoin (Braintree charges no fees for the first $1,000,000).

Contractual requirements: none; you can leave Braintree at any moment and take all your data free of charge.

Payout: 2-5 days (international merchants might have different policies).

How Braintree integration may look in your app

Features

All three gateways have dozens of features. While most of them are common to all the payment solutions, I’ve made the list of most important and unique features for each system.

PayPal:

- A hosted gateway + PCI compliance with PayPal Standard/Express Checkout or an integrated gateway with Payments Pro.

- Payflow gateway. A standalone solution for those who already have a merchant account. You can choose any major bank to process your payments and at the same time accept PayPal, PayPal Credit, authorizations, captures, and voids. You can also host the gateway on your site eliminating the disrupting redirects (Pro version only).

- Recurring billing and subscriptions.

- One Touch payments. Login once to Braintree, PayPal, or Venmo and make purchases without ever having to re-enter payment and shipping information.

- PayPal Here. A mobile payments app/basic point-of-sale solution.

- Online Invoicing for no extra fees. With Invoicing API you can customize your invoices and automate the accounts receivable workflow. Meanwhile, the reminder API allows you to send overdue payment notices.

- PayPal for marketplaces. Get a share out of each purchase made on your e-commerce or crowdfunding platform. The Adaptive Payments API allows you to accept payments in every country supported by the gateway. But beware: subscriptions are limited to $2,000, the checkout is non-customizable and redirects users to PayPal’s site.

- Payouts. Pay hundreds of recipients simultaneously.

- Instant Transfer. Move your PayPal funds to your main account for $0.25.

- Micropayments. Pay lower PayPal fees for digital and physical goods that cost <$10

- Paypal Credit. Provide no-interest loans to your users.

- Business in a Box. A starter pack for e-commerce businesses that includes a PayPal account, Xero and WooCommerce discounts as well as Working Capital, PayPal’s business loan.

- Company loans of up to 18% of the revenue you earn via PayPal.

Stripe:

- Stripe Checkout. An expertly designed payment form you can embed on your website. It gives you rich customization options and doesn’t redirect users away from your app. Moreover, the sensitive information never reaches your servers making you PCI-compliant.

- One-touch payments. Stripe allows users to save their credit card details and bind them to their email/phone number.

- Sigma, the best in class reporting tool with monthly summary reports and bookkeeping software integration. The tool offers unrivaled customization options with custom SQL queries.

- Recurring billing. Stripe supports daily, weekly, monthly, yearly, and delayed bills via its Subscription API. You can add trial periods and discounts. If a user changes his/her subscription mid-month, the system will automatically calculate the amount due.

- Stripe Atlas makes it incredibly easy to start a global business (especially a tech startup). For $500 (no additional fees) you can set up a company incorporated in Delaware, US and get it running within a few days. All without the tedious paperwork and complicated fees.

- Stripe Connect. A flexible marketplace toolkit. In addition to dividing payments between the merchants and platform owners, Stripe allows custom onboarding, payout policies, reporting, and more. Unlike its competitors, a Stripe-powered marketplace doesn’t have to specialize in selling a single category of goods (i.e. some vendors can sell clothes while others are free to offer furniture in the same app).

- Relay, an API that allows you to sell goods on Twitter, Pinterest, and other apps.

- Radar, a trademark anti-fraud system that combines machine learning with a customizable ruleset.

- Data migration assistance in case you want to leave Stripe for another provider.

- Instant Deposit. Transfer money to your main account for a 1% fee.

Braintree:

- Braintree Direct. A dedicated merchant account and a payment gateway in one nice package.

- Support for third-party merchant accounts. Open a merchant account in any US bank and use Braintree as your payment gateway.

- Integrated checkout. Choose a readymade checkout with a Drop-in UI or build your own custom experience with remotely-hosted fields that free you from the majority of PCI requirements.

- Re-billing: Braintree Vault allows you to store the sensitive information including the payment methods so that users won’t have to re-enter their data when they make a purchase. This feature works both for re-billing and one-time transactions. Braintree also allows custom discounts, pricing plans, push notifications, timed promotions, and bonuses. And if a recurring transaction fails, the gateway will automatically re-bill the client.

- Braintree Auth (currently in beta) allows platform owners and various service providers to connect with Braintree vendors and act on their behalf. Now you can, for instance, set up credit card payments for all vendors on your e-commerce platform via a sole onboarding flow.

- Braintree marketplace. For no additional fees, you get a suite of tools to manage your own platform.

- Contextual Commerce. Sell your own goods and services inside of your partners’ apps. Share your data in a secure way with Braintree merchants and other PCI compliant parties.

- Data portability. Braintree will assist you in importing/exporting customer data free of charge.

Takeaway: Of the three gateways, only Braintree offers dedicated merchant accounts. You can also use it (as well as Payflow) as a standalone gateway, although this isn’t the cheapest solution.

PayPal Standard offers the weakest UX with its disrupting redirects and non-existent customization. You can, of course, upgrade to Payments Pro, but you’ll need a developer to integrate the gateway.

At this point, Braintree and Stripe are much better alternatives.

Unfortunately, they don’t support Point of Sale transactions and don’t have a virtual terminal. You can accept phone orders via Stripe’s dashboard (although, due to PCI requirements, it’s better to use an invoicing solution).

Stripe offers the best marketplace tools (followed closely by Braintree’s) but doesn’t support mass payments. Its Atlas program is one of the easiest ways to start a US-based international business.

All three gateways offer extensive reporting tools, but only Stripe supports custom SQL queries.

Fees

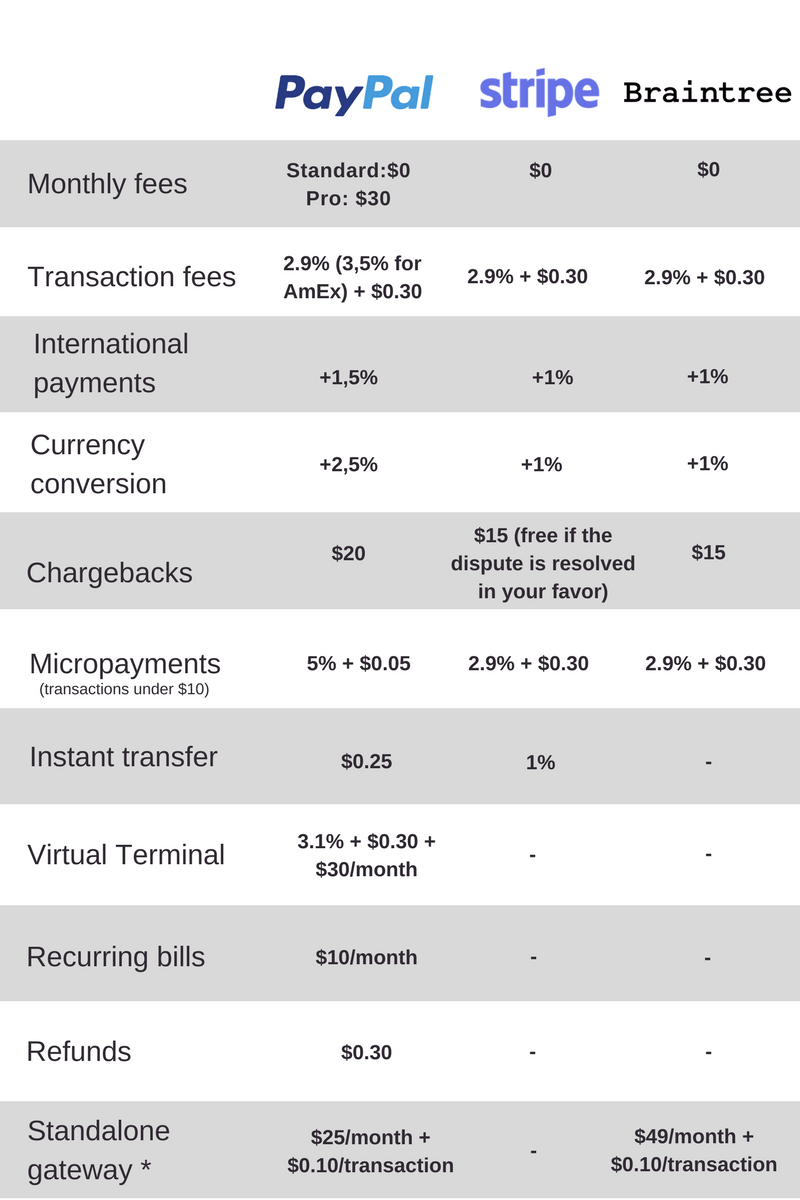

All three gateways have transparent pricing and no hidden costs (although PayPal has a whole bunch of additional fees).

* Both PayPal and Braintree work with third-party merchant accounts.

With its extra fees and higher international rates, PayPal is the most expensive option. However, If you sell lots of goods for less than $10, you can actually save money with its micropayment fees.

While Braintree charges no fees for the first $50,000, Stripe will refund you the chargeback fees if the dispute is resolved in your favor.

Security

Source: magenest.com

All three gateways are secure payment services validated PCI DSS level 1 compliant service providers that pay great attention to their security (including encryption and tokenization of sensitive data).

PayPal allows you to store user credit cards in a secured vault instead of your own servers. But the data still goes through your system first, leaving room for mistakes and making PCI compliance harder.

Some merchants find PayPal’s fraud protection lacking, but for $10/month + $0.05/transaction, you can get the advanced anti-scamming toolkit.

Stripe revolutionized online payments with Stripe.js, a library that promotes secure development practices. User credit card data goes straight to Stripe’s secure vault, never hitting your servers. This makes you PCI compliant as well as safeguards from possible data breaches.

Braintree’s security is comparable to Stripe. Fraud-protection includes 3D Secure and advanced anti-scam options from Kount. You can customize the parameters to automatically decline transactions based on specific red flags. Just keep in mind that the service isn’t always compatible with shopping cart integrations.

Setup

PayPal’s Payment Buttons can be integrated by simply pasting a short HTML fragment to your site. This option allows you to create a (somewhat) customizable payment button and integrate it with your application without any coding skills.

Express Checkout and PayPal Pro, on the other hand, require technical expertise. You can either use Payments REST API or Braintree Direct SDK. In addition to the pre-set options, the SDK allows extensive customization starting with just ten lines of code. It also allows you to manage all your integrations from a single control panel.

PayPal used to have incredibly poor APIs but had to up its game after Stripe introduced its extremely well-made developer tools. Although its current API is a clear improvement over the old buggy tools, they are still miles behind both Stripe and Braintree.

Stripe was built for developers. Its clean and well-documented APIs offer an extremely reliable and thought out framework for building custom integrations.

A wide range of supported languages (Java, PHP, Ruby, Python, Go, Node, .NET) and platforms (web, Android, and iOS), allows using Stripe for payments in almost any project.

The gateway’s documentation and SDK are by far the most extensive of the three systems. In addition to official libraries, there’s a number of community-created libraries and plugins for WordPress, Joomla, Magento, etc.

Braintree is another developers-oriented gateway. The documentation is split into sections for Android, iOS, and web. The Braintree Direct SDK supports a wide range of backend languages (Java, PHP., Node.js, NET, Ruby, and Python).

To begin, download the relevant SDK, generate a token, and set up the drop-in UI. Only a couple lines of code will get you going.

Or you could go with the Custom UI and create your own checkout experience.

Support

PayPal’s customer service is available via email and by phone (Mon-Fri from 5 AM to 10 PM PT/ Sat-Sun from 6:00 AM to 8:00 PM PT).

Calling PayPal should be seen as a last resort after you’ve exhausted the self-help options. The hotline is notorious for its sub-par service.

On the upside, the gateway has A LOT of users, so you’ll likely find your answers just by Googling. Unfortunately, some issues, such as frozen accounts, require you to contact the support center.

Stripe provides no live support and instead relies on email communications.

This is a bad news if you can’t accept payments and need your answers ASAP.

Fortunately, Stripe has an IRC channel (#stripe) where you can get help from real developers, company reps, and users with similar problems. You can also follow Stripe on social media and ask your questions there or get status updates via Twitter and Stripe’s website.

There’s also a knowledge base and an extremely helpful developers documentation (you should check it out even if you’re not an engineer yourself).

Braintree is famous for its outstanding support. In addition to phone (8 AM – 7 PM CST, MON – THU; 8 AM – 5 PM CST, FRI) and email communications (24/7 in emergencies), Braintree provides a detailed FAQ, multiple support articles, and guides.

You can also see the status of their services on Braintree’s website.

Complaints

PayPal is huge so it naturally has tons of dissatisfied customers. Just remember that a lot of PayPal complaints come from the digital wallet users or eBay customers, not the merchants.

Still the common thread among the negative reviews is PayPal freezing/terminating the merchant accounts or withholding funds.

Like most aggregate gateways, PayPal doesn’t run a thorough background check before they approve your account. This shortens the approval time but increases risks for the provider. That’s why PayPal will crack down on any activity they deem suspicious such as sudden spikes in revenue or transaction volume.

But this problem is in no way exclusive to PayPal!

Additionally, a lot of vendors complain about poor merchant protection.

At the same time, users praise PayPal for its easy setup, global reach, quick payouts (typically, 1 business day), and a plethora of features.

Stripe is also infamous for freezing/terminating accounts and withholding funds. Users also complain of support reps ignoring them, especially with the serious problems like canceled accounts.

Finally, there’s the issue of frequent chargebacks. Although they’re usually not Stripe’s fault, the gateway refuses to work with merchants who have a chargeback rate higher than 1%.

On the upside, the service often gets praise for its revolutionary APIs and developer tools.

Braintree has fewer complaints compared to other gateways on the list.

One of the issues people have with the provider is the long approval times. This is something you should expect when you apply for a dedicated merchant account.

This should, in theory, lead to fewer frozen accounts and withheld funds. Just remember that Braintree is pickier about its clients and won’t work with the high-risk merchants.

Some users have problems with unresponsive customer service or complicated setup.

At the same time, developers praise the gateway for its excellent APIs and the support for a wide range of programming languages.

Conclusions

And that’s pretty much everything about Stripe vs. PayPal vs. Braintree in our payment gateway comparison.

PayPal is a great entry-level solution you can set up without any development skills and accept payments within minutes. But if you want an integrated checkout or extensive customization, you’ll have to opt for a more expensive plan (as well as hire a developer).

Its micropayment fees are unmatched for goods under $10. But to get the advanced features, you’ll have to pay additional fees.

Stripe is aimed at larger businesses, complex SaaS products, marketplaces. It’s the best choice if your app will benefit from customization and rich reporting. Stripe Atlas is a solid foundation for your tech startup and an excellent framework for growth.

But if you want a simple out of the box solution, PayPal is a far better alternative.

Braintree is an excellent choice for almost any type of business (especially enterprises). While lacking PayPal’s plug and play approach, it makes up for it with excellent customization and flexibility. Moreover, it’s the only of three gateways that offers dedicated merchant accounts with all their benefits and drawbacks.

Braintree has great reporting tools but unlike Stripe, it doesn’t support custom SQL queries.

Now that you know all the gateways’ strengths and weaknesses, you can choose the solution that best suits your application. But if you have trouble picking the right payment system or need a qualified team to integrate it, you can always contact MindK.

We have experience with both global gateways, such as Paypal or Stripe, and local online payment solutions, such as PayEx (Scandinavia) or Vipps (Norway).